Growing Demand for Gluten-Free Bakery Products Drives Gluten-free Products Market Growth

According to our latest study on "Gluten-free Products Market Forecast to 2031, Global and Regional Growth Opportunity Analysis – by Product Type and Distribution Channel," the market was valued at US$ 7.67 billion in 2024 and is expected to reach US$ 13.49 billion by 2031; it is estimated to register a CAGR of 8.4% during 2025–2031. The report highlights key factors contributing to the growing gluten-free products market size and prominent players, along with their developments in the market.

Many consumers perceive gluten-free products as a healthier option, often associating them with benefits such as improved digestion, weight management, and increased energy levels. The shift toward gluten-free products is driven by rising interest in gluten-free diets among health-conscious individuals. Gluten-free bakery products often emphasize their use of alternative flours made from almonds, coconut, oats, and sorghum, which are perceived as healthier options over conventional wheat. Key market players focus on product developments and launches to expand product offerings with improved sensory characteristics. Advancements in food technology have led to significant improvements in gluten-free products, making them indistinguishable in their texture and taste from conventional food products.

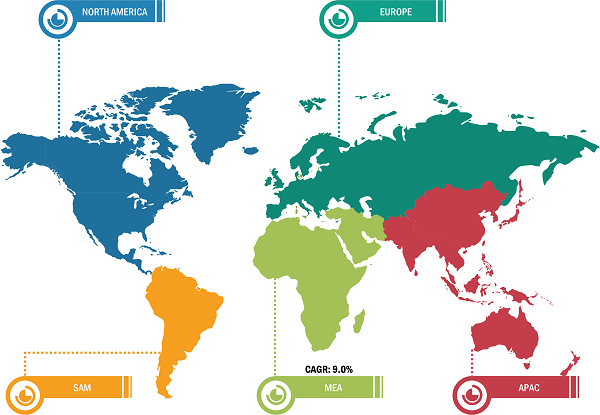

Gluten-free Products Market Breakdown – by Region

Gluten-free Products Market Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Bakery Products (Cakes and Muffins, Biscuits and Cookies, Pizza, Bread and Rolls, and Other Bakery Products), Confectionery Bars, Pasta and Noodles, Breakfast Cereals, Snacks, RTE and RTC Meals, Flour, and Others], Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others), and Geography

Gluten-free Products Market Size, Trends & Forecast 2031

Download Free Sample

The growing demand for gluten-free bakery products has encouraged manufacturers to launch distinct bakery products globally. For instance, in 2023, Mary's Gone launched 3 better-for-you ranges that include gluten-free crackers in supermarkets across the Middle East. In 2023, Mondelez International Inc. launched OREO gluten-free mint cream chocolate sandwich cookies. In December 2023, Modern Mills Company launched gluten-free ingredients for bakery products, which include multipurpose flour, pizza and pastry flour, and cake and dessert flour products. These factors are driving the gluten-free products market growth.

The gluten-free products market analysis has been performed by considering the following segments: product type and distribution channel. In terms of product type, the market is segmented into bakery products (cakes and muffins, biscuits and cookies, pizza, bread and rolls, and other bakery products), confectionery bars, pasta and noodles, breakfast cereals, snacks, RTE and RTC meals, flour, and others. The bakery products segment accounted for the largest gluten-free products market share in 2024. The gluten-free bakery products tend to have a different texture from traditional breads and treats. Depending on the ingredients, these products are denser and have a gritty texture. Various gluten-free flours, starches, and baking aids are utilized to produce high-quality bakery products, such as cakes and muffins, biscuits and cookies, pizza, bread, and rolls. The gluten-free baked products are known to be a healthier option than traditional wheat flour-based baked products. The rising demand for health-conscious food products has resulted in increased consumption of gluten-free bakery products.

The gluten-free products market trends include the rising consumer preference for clean-label and fortified gluten-free products. As more people adopt healthy lifestyles, they seek products that offer more health benefits than just gluten-free. Consumers have associated clean-label products with better health prospects. While gluten-free products are essential for individuals with celiac disease and gluten intolerance, there is a growing assumption that gluten-free products lack fiber, vitamins, and minerals. To address this gap and appeal to health-conscious consumers, key market players have developed fortified formulations. The demand for functional food products that offer health benefits has also positively influenced the gluten-free products market. Consumer preferences have shifted toward specific health goals, such as improved digestion, enhanced energy level, and better immune function. Gluten-free products fortified with probiotics, omega-3 fatty acids, or antioxidants cater to these needs, offering consumers options to fit their wellness routine. The influence of international health trends and the availability of global and international brands across the globe have further accelerated the adoption of clean-label products. The major retailers, such as Carrefour, Lulu Hypermarket, Walmart, Tesco, and online platforms, offer international gluten-free brands, thus providing customers with various options that meet international clean label standards. The trend of clean label food is a response to a combination of factors such as rising health awareness, demographic shifts, and the influence of international brands. This trend has led to the development of gluten-free, clean-labeled, and fortified products, positioning them as premium and healthy food products.

North America dominated the gluten-free products market share in terms of revenue in 2024. The gluten-free products market in North America is shaped by growing consumer awareness around food sensitivities, evolving labeling regulations, and strategic advancements in manufacturing and distribution. Regulatory oversight from agencies such as the US Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA) plays a pivotal role in guiding the development, labeling, and safety of gluten-free foods across the region. The FDA's regulation on gluten-free labeling, which mandates that products must contain less than 20 parts per million (ppm) of gluten to bear a "gluten-free" label, has provided both consumers and manufacturers with clarity and consistency. Similarly, the CFIA enforces clear standards for gluten-free claims, ensuring that products sold in the Canadian market are safe for individuals with celiac disease and gluten intolerance. These harmonized regulatory frameworks across North America have laid the foundation for innovation and market expansion in gluten-free food categories such as baked goods, snacks, cereals, and ready-to-eat meals.

Moreover, North America has witnessed a significant increase in production capabilities and regional investments aimed at meeting the rising demand for gluten-free alternatives. For instance, in June 2025, Eshbal, a gluten-free baked goods manufacturer, expanded its reach in North America via the establishment of a US-based manufacturing facility and through the acquisition of a strategic partner in the region. The move is aimed at bolstering the production and distribution of its gluten-free pita bread. This product line caters to growing consumer interest in ethnic and functional foods that adhere to gluten-free standards. The expansion underscores a broader trend in the North American market where international companies are increasingly investing in local infrastructure to reduce supply chain dependencies and accelerate market responsiveness. As consumer demand continues to evolve toward cleaner labels, plant-based nutrition, and allergen-conscious formulations, the gluten-free products market is expected to remain dynamic and innovation-driven. Ongoing collaboration between food technologists, regulatory agencies, and private enterprises is likely to shape the future of gluten-free foods, not only from a safety perspective but also in terms of taste, texture, and nutritional density.

American Garden, Mondelez International Inc, Dr. Schär Spa, Nestle SA, General Mills Inc, Hunter Foods LLC, Blue Diamond Growers, Mister Free'd, YummyEarth Inc, and Galletas Gullon SA are among the prominent players profiled in the gluten-free products market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market.

The gluten-free products market is segmented based on product type, distribution channel, and geography. Based on product type, the market is segmented into products (cakes and muffins, biscuits and cookies, pizza, bread and rolls, and other bakery products), confectionery bars, pasta and noodles, breakfast cereals, snacks, RTE and RTC meals, flour, and others. In terms of distribution channel, the gluten-free products market is categorized into supermarkets and hypermarkets, convenience stores, online retail, and others.

The geographical scope of the gluten-free products market report focuses on North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The gluten-free products market in North America is further segmented into the US, Canada, and Mexico. The market in Europe is subsegmented into Germany, France, the UK, Spain, Italy, and the Rest of Europe. The gluten-free products market in Asia Pacific is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The gluten-free products market in the Middle East & Africa is subsegmented into South Africa, Saudi Arabia, the UAE, Qatar, Morocco, and the Rest of Middle East & Africa. The market in South & Central America is further segmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com