Hepatitis B & C Segment to Lead Infectious Disease In vitro Diagnostics Market During 2025–2031

According to our new research study named "Infectious Disease In vitro Diagnostics Market Forecast to 2031 – Global Analysis – by Application and End User," the market was valued at US$ 45.69 billion in 2024 and is projected to reach US$ 76.71 billion by 2031; it is expected to register a CAGR of 7.7% during 2025–2031. The increasing prevalence of infectious diseases and strategic developments by key players drive the adoption of infectious disease in vitro diagnostics. However, the inadequate reimbursement scenario hinders the market growth. Technological advancements are projected to bring new infectious disease in vitro diagnostics market trends in the coming years.

Infectious disease in-vitro diagnostics (IVDs) are laboratory-based tests used to detect pathogens such as bacteria, viruses, fungi, or parasites from human samples like blood, saliva, or tissue. These tests help diagnose diseases such as HIV, hepatitis, tuberculosis, COVID-19, and influenza. IVDs include molecular diagnostics, immunoassays, and microbiological techniques. They are essential for early detection, effective treatment, and monitoring of infectious diseases, owing to which they play a critical role in public health and hospital infection control.

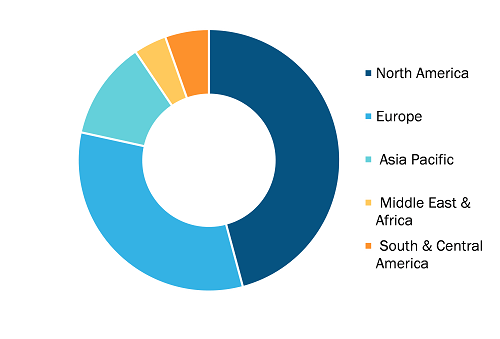

Infectious Disease In vitro Diagnostics Market, by Region, 2024 (%)

Infectious Disease In vitro Diagnostics Market Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Application (HIV or AIDS, Tuberculosis, Hepatitis B and C, Malaria, and Others), End User (Hospitals and Clinics, Diagnostic Laboratories, Blood Bank, and Others), and Geography

Infectious Disease In-vitro Diagnostics Market Research – Size, Share, Developments and Future Scope 2031

Download Free Sample

Source: The Insight Partners Analysis

The rising prevalence of infectious diseases, technological advancements in diagnostics, increased awareness and screening, and growing demand for rapid and accurate testing are contributing to the growing infectious disease in vitro diagnostics market size. The COVID-19 pandemic significantly accelerated market growth by expanding global diagnostic capacity and infrastructure. Moreover, increasing government funding, improved healthcare access in emerging economies, and the shift toward point-of-care testing contribute to market expansion. The need for timely diagnosis to control outbreaks and antimicrobial resistance also propels the demand for advanced IVD solutions in both clinical and research settings.

Infectious Disease In vitro Diagnostics Market Analysis Based on Segmental Evaluation:

Based on application, the infectious disease in vitro diagnostics market is segmented into HIV/AIDS, tuberculosis, hepatitis B & C, malaria, and others. The hepatitis B & C segment held a significant infectious disease in vitro diagnostics market share in 2024. According to the Coalition for Global Hepatitis Elimination, Nigeria has one of the highest burdens of viral hepatitis, with national prevalence rates of 8.1% for hepatitis B (HBV) and 1.1% for hepatitis C (HCV) among adults, i.e., an estimated 19 million Nigerians living with chronic HBV and HCV infections. The high prevalence of these infections increases the burden on the healthcare system and highlights the need for accessible diagnostic testing. This substantial disease burden is driving the demand for advanced in vitro diagnostic solutions that can provide reliable, rapid, and cost-effective testing. Enhancing the availability and affordability of such diagnostic tools enables large-scale screening programs, facilitates timely treatment interventions, and ultimately reduces the morbidity as well as mortality associated with chronic HBV and HCV infections globally.

The geographical scope of the infectious disease in vitro diagnostics market report includes the assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, and the Middle East and Africa. In terms of revenue, North America held the largest infectious disease in vitro diagnostics market share in 2024. The growing focus of the Centers for Disease Control and Prevention (CDC) has established several international laboratory projects in North America. This includes two projects for the detection of drug-sensitive and drug-resistant TB cases in Sonora and Baja California, Mexico. The common goal of these two projects is to build capacity for the state and national disease control program to identify the group at risk and conduct rapid TB tests on that group. These initiatives for screening the masses for TB are creating awareness in the Mexican population. In addition, the rapidly growing pharmaceutical industry, developing healthcare infrastructure, and increasing demand for diagnostic testing products bolster the infectious diseases in vitro diagnostics market growth in North America. Additionally, the increasing acceptance of technologically advanced products, rising research and development activities, and growing use of in vitro diagnostics kits for infectious disease diagnosis, as well as the presence of large healthcare businesses, favor the infectious disease in vitro diagnostics market growth in North America.

The US comprises the largest infectious disease in vitro diagnostics market in the world and is among the countries growing at a faster rate in the global infectious disease in vitro diagnostics market. Infectious diseases are growing significantly in the country. For instance, according to the Centers for Disease Control and Prevention, 9,633 cases of TB disease were reported in 2023 in the US. This is an increase in the number of cases by 15.6% from 2022 (8,332 TB disease cases) and 8.3% from 2019 (8,895 TB disease cases), which was the year previous to the COVID-19 pandemic.

Market players are adopting organic and inorganic growth strategies for expansion, thereby contributing to the infectious disease in vitro diagnostics market growth. For instance, in August 2024, MP Biomedicals completed its range of in vitro diagnostic infectious disease tests with fresh immunochromatographic-based qualitative rapid tests. MP Biomedicals' new diagnostic kits utilize advanced technology to provide accurate results, allowing health professionals a quick and accurate identification of Helicobacter pylori, Salmonella typhi, and Vibrio cholerae serogroups O1 and O139. Similarly, in March 2025, bioMérieux’s VITEK COMPACT PRO received the US Food and Drug Administration (FDA) 510(k) clearance. This advanced system for microorganism identification and antibiotic susceptibility testing is used in clinical laboratories to diagnose infectious diseases and fight antimicrobial resistance (AMR), as well as industrial laboratories to identify contaminants for maintaining consumer safety. Also, in August 2024, InBios International Inc., a prominent developer and producer of diagnostic tests for newly emerging infectious diseases and biothreats, is introducing an in vitro serological ELISA kit for presumptive clinical laboratory diagnosis of Strongyloides infection that provides results in 75 minutes.

Moreover, Canada is experiencing a growing number of infectious diseases, and increasing favorable government regulations to encourage the development of infectious disease diagnostics. For instance, according to a report published by the government of Canada, the prevalence of HIV in Canada has grown by ~35.2% since 2022, and 2,434 new HIV cases were reported in 2023. Additionally, market players are adopting various growth strategies for expansion, which bolsters the growth of the infectious disease in vitro diagnostics market. In June 2025, Health Canada granted Cepheid a medical device license for Xpert HIV-1 Viral Load XC, a next-generation extended-coverage (XC) test to support the evaluation of HIV viral load levels, to measure the success of antiretroviral treatment.

Abbott Laboratories, F. Hoffmann-La Roche Ltd., Becton Dickinson and Co., Sysmex Corp., bioMerieux SA, Bio-Rad Laboratories Inc., QIAGEN NV, QuidelOrtho Corp., and Bruker Corp. are among the leading companies profiled in the infectious disease in vitro diagnostics market report.

Based on application, the infectious disease in vitro diagnostics market is segmented into HIV/AIDS, tuberculosis, hepatitis B & C, malaria, and others. In terms of end user, the infectious disease in vitro diagnostics market is segmented into hospitals and clinics, diagnostics laboratories, blood bank, and others. Geographically, the market is categorized into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East and Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East and Africa), and South and Central America (Brazil, Argentina, and the Rest of South and Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com