Growing Demand for Organic Food Bolsters Biostimulants Market Growth

According to our latest study on "Biostimulants Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – Product Type, Mode of Application, and Crop Type," the market size is expected to grow from US$ 5.55 billion in 2024 to US$ 8.41 billion by 2031; the biostimulants market is estimated to register a CAGR of 6.3% from 2025 to 2031. The report highlights key factors driving the biostimulants market growth and prominent players along with their developments in the biostimulants market. Apart from the growth drivers, the report covers the biostimulants market trends and their foreseeable impact during the forecast period.

Consumers worldwide have become more health-conscious and aware of the environmental impacts of conventional farming; organic products have gained significant traction. Organic food is perceived as a healthier, safer, and more environmentally friendly alternative, as it is free from synthetic chemicals and pesticides. This growing preference has prompted several farmers and agricultural companies to explore innovative solutions that can help improve crop yields. The transition toward sustainable agricultural practices has urged the use of biostimulants. Biostimulants derived from seaweed extracts, amino acids, humic substances, microorganisms, and other natural extracts enhance plant crop performance by improving plant resilience against environmental stresses, such as elevated temperatures, drought, and soil salinity. The most prevalent microbial biostimulants include arbuscular mycorrhizal fungi, species of Trichoderma fungi, and rhizosphere bacteria (plant growth-promoting rhizobacteria). These microorganisms form symbiotic relationships with plants, enhancing their overall health and productivity. According to the data from the European Biostimulants Industry Council, biostimulants can enhance nutrient absorption and utilization by up to 25% while improving the intrinsic quality of crops—such as size, color, ripeness, and impact resistance—by up to 15%.

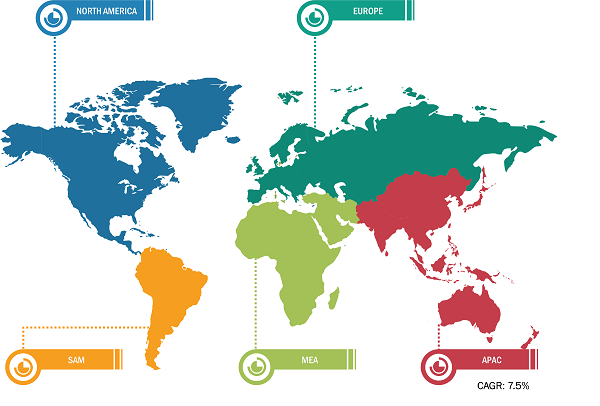

Biostimulants Market Breakdown – by Region

Biostimulants Market Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Humic Substances, Amino Acids, Microbial Stimulants, Seaweed Extracts, and Others), Mode of Application (Foliar Spray, Seed Treatment, and Soil Application), and Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Turf and Landscapes, and Others), and Geography

Biostimulants Market Report, Trends, Forecast to 2031

Download Free Sample

Additionally, North American countries, such as Canada, produce more than 400 varieties of crops, including almonds, strawberries, rice, and grapes. Consumption of all these products in the country supports the growth of the biostimulants market. According to the US Department of Agriculture, in 2023, Canada remained among the top export markets for US agricultural exports, accounting for 16.3% of US agricultural exports and 20.6% of the US agricultural imports, contributing to the biostimulants market share globally.

Several emerging and developed countries worldwide have adopted organic farming, which has resulted in a high demand for biostimulants globally. For instance, China is experiencing a growing shift toward organic farming due to favorable government policies, such as the National Soil Pollution Control Plan and the Healthy Soil Action Plan, aimed at supporting organic farming, enhancing soil quality, and reducing greenhouse gas emissions. According to the report published by the Research Institute of Organic Agriculture in 2024, China had 2.9 million hectares of organic-certified land in 2023. The report also reveals that China was the leading producer of organic cereals in 2022, accounting for 1.4 million hectares of land; organic temperate fruits such as apples, with 126,000 hectares of orchards under organic management; and organic oilseeds, with 506,000 hectares of land.

Additionally, agriculture is a cornerstone of the Indian economy as most of the population depends on it for their livelihoods. Government schemes and programs such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and the National Mission for Sustainable Agriculture (NMSA) emphasize the importance of soil health and water conservation, creating a conducive environment for the adoption of biostimulants as a soil amendment. Furthermore, as per the General Authority for Statistics, in 2023, the total organic farming area in Saudi Arabia reached 23,400 hectares, whereas the organic crop production amounted to 95,300 tons. Thus, such growing organic farming worldwide contributes to the market growth as a fertilizer in the biostimulants market.

The biostimulants market analysis has been performed by considering the following segments: product type, mode of application, and crop type. Based on product type, the biostimulants market is segmented into humic substances, amino acids, microbial stimulants, seaweed extracts, and others. The seaweed extracts segment held the largest share in the global biostimulants market in 2024. In terms of mode of application, the biostimulants market is segmented into foliar spray, seed treatment, and soil application. The foliar spray segment held the largest share in the biostimulants market in 2024. By crop type, the biostimulants market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, turf and landscapes, and others. The cereals and grains segment held the largest share of the biostimulants market in 2024. In modern agriculture, various products classified as plant growth stimulants are used along with fungicides, herbicides, and insecticides. The horticultural sector includes a wide range of crops, such as vegetable crops, fruit crops, tuber crops, medicinal & aromatic crops, and spices, as well as cereals and grains such as wheat, maize, sorghum, mungbean, barley, finger millet, and soybean. The role of biostimulants is to control and accelerate the life processes of these plants, stimulate their development, and increase their resistance to stress.

Europe dominated the biostimulants market share in terms of revenue in 2024. France was the largest contributor to the region in terms of revenue in 2024. Its dominance is underpinned by progressive agricultural policies that support the adoption of eco-friendly biostimulant solutions over conventional agrochemicals. French farmers, particularly those cultivating cereals and oilseeds, have shown a pronounced inclination toward amino acid-based biostimulants, which are increasingly recognized for their efficacy in bolstering plant resilience and optimizing yields under abiotic stress conditions. Biostimulants are no longer viewed as optional enhancements but as integral tools in achieving national targets related to environmental woes, particularly the reduction of chemical fertilizer dependency without compromising output. Additionally, France benefits from a highly developed distribution infrastructure and a mature ecosystem encompassing key biostimulants manufacturers, ensuring product accessibility and strong technical support across its farming regions. This well-orchestrated alignment of policy, demand, and supply is expected to fuel continued market expansion in France.

The market growth in Germany is attributed to the rising adoption of biostimulants among farmers seeking to enhance crop yields, improve soil health, and reduce reliance on chemical fertilizers. German farmers are increasingly looking for sustainable farming solutions due to both market demand and regulatory pressure. Biostimulants are seen as a way to improve productivity while ensuring the environment is unaffected by farming practices. The German government has been pushing for sustainable agriculture through various initiatives, including subsidies and research funding. Biostimulants play a role in meeting these national sustainability goals. Major global biostimulants companies, including BASF, Syngenta, Bayer CropScience, and Valagro, are present in the German market. Local German firms such as AgroChemica GmbH and Wacker Chemie AG are also among the prominent players.

The biostimulants market forecast can help stakeholders plan their growth strategies. BASF SE, UPL Limited, Valagro, Gowan Company, FMC Corporation, ILSA S.p.A., Haifa Negev Technologies LTD., ADAMA, Rallis India Limited, and AgriTecno Biostimulants and Plant Nutrition are among the prominent players profiled in the biostimulants market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the biostimulants market.

The geographical scope of the biostimulants market report focuses on North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America is further segmented into the US, Canada, and Mexico. The market in Europe is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The market in Asia Pacific is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The biostimulants market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the Middle East & Africa. The market in South & Central America is further segmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com