$4550

$3640

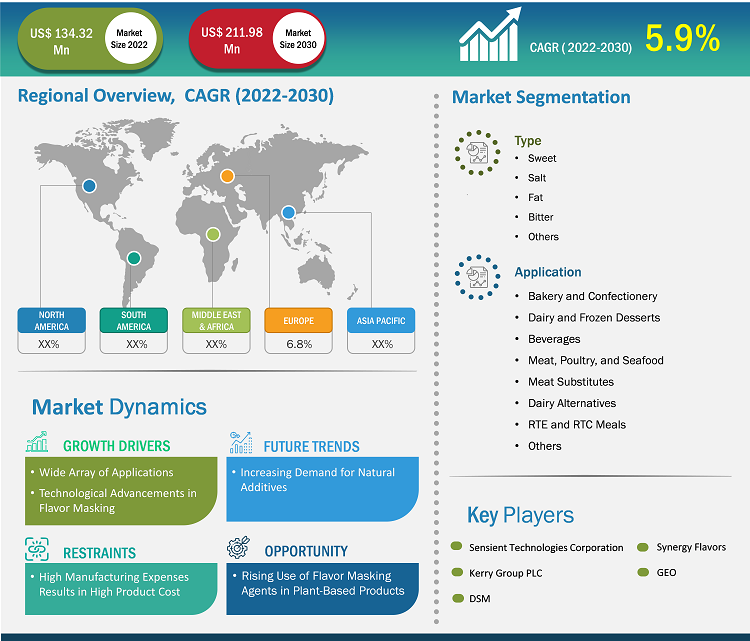

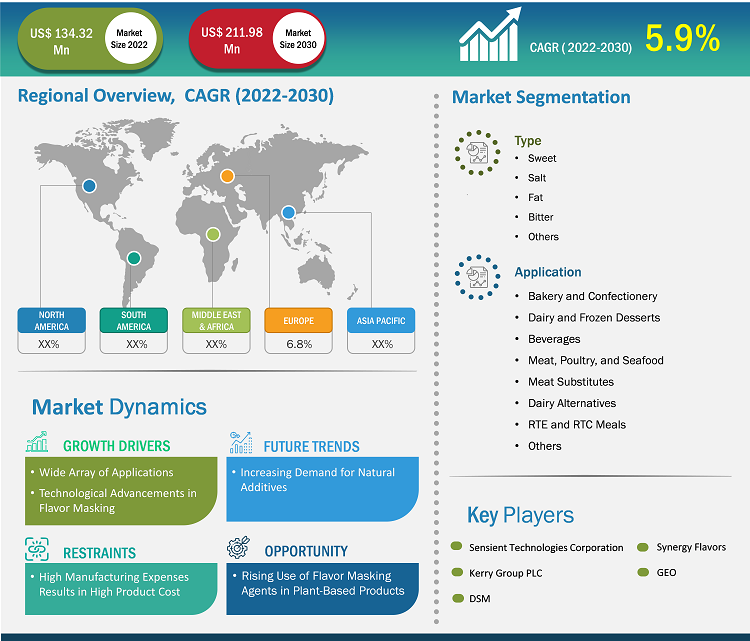

[Research Report] The flavor masking agents for food and beverages market size is projected to grow from US$ 134.32 million in 2022 to US$ 211.98 million by 2030. The market is expected to record a CAGR of 5.9% from 2022 to 2030.

Market Insights and Analyst View:

Flavor masking agents are ingredients or additives used to mask undesirable flavors in various food and beverages such as bakery and confectionery, dairy and frozen desserts, meat alternatives, dairy alternatives, meat and seafood products, and savory snacks. The agents enhance the palatability of food by masking the off-notes such as bitterness, sweetness, saltiness, sourness, fat-flavor, metallic off-notes, chalkiness, beany and grassy flavors, and others. Flavor masking agents also include various flavor systems, including taste modulators, bitterness suppressors, sweetness suppressors, and fat modulators.

Growth Drivers and Challenges:

Many processed fortified foods such as dairy items, meat products, and bakery and confectionery items contain vitamins, protein, and other functional ingredients with unpleasant odors and tastes. Flavor masking agents are widely used in these products to get the desired flavor and taste. Additionally, the agents allow for a reduction in the sugar, salt, and fat content of processed foods. Thus, increased consumption of processed foods propels the need for flavor masking agents. Moreover, the growing interest of consumers in healthier lifestyles drives demand for fortified, functional, and other convenient, functional foods and beverages, such as products with less sugar. However, the boosting functional benefits can hamper the taste and flavors of the end product. Thus, to get the desired flavor, functional and convenient food manufacturers use flavor masking agents. For instance, flavor masking agents are significantly used in protein-based food products to eliminate or neutralize the off-flavor or undesirable flavor of protein. Thus, a wide array of applications of flavor masking agents in various food and beverages boosts the global flavor masking agents for food and beverages market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Flavor Masking Agents for Food and Beverages Market: Strategic Insights

Market Size Value in US$ 134.32 million in 2022 Market Size Value by US$ 211.98 million by 2030 Growth rate CAGR of 5.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Flavor Masking Agents for Food and Beverages Market: Strategic Insights

| Market Size Value in | US$ 134.32 million in 2022 |

| Market Size Value by | US$ 211.98 million by 2030 |

| Growth rate | CAGR of 5.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The global flavor masking agents for food and beverages market is segmented on the basis of type, application, and geography. The flavor masking agents for food and beverages market, by type, is segmented into sweet, salt, fat, bitter, and others. Based on application, the market is segmented into bakery and confectionery; dairy and frozen desserts; beverages; meat, poultry, and seafood; meat substitutes; dairy alternatives; RTE and RTC meals; and others. The flavor masking agents for food and beverages market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

Based on type, the flavor masking agents for food and beverages market is segmented into sweet, salt, fat, bitter, and others. The bitter segment holds a significant share of the market. The demand for bitter flavor masking agents is growing primarily due to consumers' sensitivity to bitterness and the expansion of products with bitter components. As consumer preferences evolve and the market diversifies with the introduction of new beverages, functional foods, fortified food and beverages, and health-focused products, the need for effective bitter flavor masking agents increases. These agents enable the creation of a broader range of palatable products that cater to various consumer segments, addressing the demand for better-tasting, bitter-sensitive-friendly options in the market. These factors drive the market growth for the bitter segment.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Regional Analysis:

Based on geography, the flavor masking agents for food and beverages market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global flavor masking agents for food and beverages market; the market in this region was valued at US$ 50,557 million in 2022. The market in Europe is expected to register a CAGR of 6.8% during the forecast period. Developed and developing countries in Asia Pacific witness growth in urbanization, coupled with the rising middle-class population, offering several opportunities for the market players. The diverse and multicultural nature of Asia Pacific has resulted in dietary restrictions and preferences. The region reports increased demand for plant-based food products coupled with an upsurge in the vegan population. Flavor masking agents play a crucial role in enabling manufacturers to create plant-based food products with exciting and novel flavor combinations, enhancing the appeal of their products to a wider consumer base. These factors propel the flavor masking agents for food and beverages market growth in Asia Pacific.

North America accounts for the second-largest share of the flavor masking agents for food and beverages market, accounting for nearly ~25% market share. The demand for flavor masking agents is upsurging as consumers become health-conscious and actively seek food products with low sugar, low fat, low sodium, and low salt. This rise in demand for reduced salt and sugar products has led to increased usage of artificial sweeteners and sugar substitutes, which can have distinct aftertastes, requiring masking. Due to this factor, the demand for flavor masking agents is rising in North America.

Industry Developments and Future Opportunities:

Initiatives taken by key players operating in the flavor masking agents for food and beverages market are listed below:

- In June 2023, Kerry announced the launch of its next-generation Tastesense Advanced portfolio of solutions that aims to redefine the low and zero-sugar product market by delivering incomparable sweetness and full-bodied mouthfeel, as well as sustainability benefits.

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several food and beverage manufacturing companies operating in the bakery & confectionery, dairy & frozen desserts, and meat & dairy alternatives industries. The shutdown of manufacturing units disturbed global supply chains, production activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in their product sales in 2020, which hampered the flavor masking agents for food and beverages market. The shortage of workforce and limited supply of raw materials also led to a halt in operations and processes across the globe during the COVID-19 pandemic. These factors negatively impacted the market growth in the pandemic.

With a shift in consumers' focus on adopting plant-based food owing to increasing veganism trends and rising health and wellness concerns during this health crisis, the demand for flavor masking agents has increased in the last few years. In 2021, various economies resumed operations as several governments revoked the previously imposed restrictions, which positively impacted the global marketplace. Moreover, manufacturers were permitted to operate at full capacities, which helped them overcome the demand and supply gaps.

Competitive Landscape and Key Companies:

Sensient Technologies Corp, Firmenich International SA, Tate & Lyle Plc, Archer-Daniels-Midland Co, Kerry Group Plc, Carmi Flavor & Fragrance Co Inc, Synergy Flavors Inc, Virginia Dare Extract Co Inc, GEO Specialty Chemicals Inc, and Koninklijke DSM NV are among the prominent players operating in the global flavor masking agents for food and beverages market. These market players adopt strategic development initiatives to expand their businesses, further driving the flavor masking agents for food and beverages market growth.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Europe is estimated to register the fastest CAGR in the global flavor masking agents for food and beverages market over the forecast period. The rising demand for plant-derived meat and dairy products due to rising veganism trend is one of the key factors significantly driving the flavor masking agents for food and beverages market growth in the region.

Based on application, the meat substitutes segment is estimated to register the fastest CAGR in the global flavor masking agents for food and beverages market over the forecast period. Rising veganism trend due to increasing awareness of animal cruelty at slaughterhouses and health benefits of plant-based food is driving the demand for meat substitute products, thereby, driving demand for flavor masking agents.

Wide array of application scope in the food industry and rising technological advancements are the two key factors driving the flavor masking agents for food and beverages market growth.

Based on type, the bitter segment held the largest share in the global flavor masking agents for food and beverages market in 2022. Bitter masking agents are witnessing high demand in meat alternatives and plant-based dairy products due to off-notes of plant-based protein such as soy, pea, and beans. This factor, thereby, drives the growth of the segment.

Sensient Technologies Corp, Firmenich International SA, Tate & Lyle Plc, Archer-Daniels-Midland Co, Kerry Group Plc, Carmi Flavor & Fragrance Co Inc, Synergy Flavors Inc, Virginia Dare Extract Co Inc, GEO Specialty Chemicals Inc, and Koninklijke DSM NV are a few players operating in the global flavor masking agents for food and beverages market.

In 2022, Asia Pacific held the largest share of the global flavor masking agents for food and beverages market. The food and beverage industry in Asia Pacific is rapidly growing with rising consumption of convenience food and beverages such as baked goods, chocolates and confectionery, dairy and frozen desserts, meat and seafood products, RTE and RTC meals, etc. This factor significantly drives the demand for flavor masking agents in the food and beverages industry across Asia Pacific.

The List of Companies - Flavor Masking Agents for Food and Beverages Market

- Sensient Technologies Corp

- Firmenich International SA

- Tate & Lyle Plc

- Archer-Daniels-Midland Co

- Kerry Group Plc

- Carmi Flavor & Fragrance Co Inc

- Synergy Flavors Inc

- Virginia Dare Extract Co Inc

- GEO Specialty Chemicals Inc

- Koninklijke DSM NV

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Flavor Masking Agents for Food and Beverages Market

Oct 2023

Corn and Wheat-Based Feed Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Corn-Based (Corn Gluten Meal, Corn Gluten Feed, and Other Corn-Based Feed) and Wheat-Based (Wheat Gluten, Wheat Bran, and Other Wheat-Based Feed)], Livestock (Poultry, Ruminants, Swine, Aquaculture, and Others), and Geography

Oct 2023

Icing and Frosting Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Icing and Frosting), Category (Gluten-Free and Conventional), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others), and Geography

Oct 2023

Fermented Flavor and Fragrance Ingredients Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Fruity, Floral, Woody, Blends, and Others), Application (Food and Beverages, Personal Care Products, Cosmetics, and Others), and Geography

Oct 2023

Aroma Ingredients for Food and Beverages Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Synthetic (Terpenes, Aldehydes, Aliphatic, and Others) and Natural (Essential Oils, Herbal Extracts, Oleoresins, and Others)] and Application (Bakery and Confectionery, Dairy and Frozen Desserts, Beverages, Sweet and Savory Snacks, RTE and RTC Meals, and Others)

Oct 2023

High-End Rum Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (White, Dark, and Gold), Category (Super Premium, Ultra-Premium, and Prestige & Prestige Plus), Nature (Plain and Flavored), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

Oct 2023

Edible Oils and Fats Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Oil (Soybean Oil, Sunflower Oil, Palm Oil, Canola Oil/Rapeseed Oil, and Others) and Fats (Butter, Margarine, Palm Oil Based Shortening, and Vegetable Oil Based Shortening, and Others)] and Application [Food and Beverages (Bakery and Confectionery, Dairy and Frozen Desserts, RTE and RTC Meals, Snacks, and Others), Animal Nutrition, and Pharmaceuticals and Nutraceuticals]

Oct 2023

Flavor Masking Agents for Food and Beverages Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Sweet, Salt, Fat, Bitter, and Others) and Application (Bakery and Confectionery; Dairy and Frozen Desserts; Beverages; Meat, Poultry, and Seafood; Meat Substitutes; Dairy Alternatives; RTE and RTC Meals; and Others)

Oct 2023

Chicken Powder Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Low-Fat and Conventional) and Application [Food & Beverages (RTE and RTC Meals; Soups, Sauces, and Dressings; Savory Snacks; Noodles and Pastas; and Others), Dietary Supplements, Pet Food, and Animal Feed]