Branded Segment to Lead Prescription Drugs Market Based on Product Type During 2025–2031

According to our new research study on “Prescription Drugs Market Forecast to 2031 – Global Analysis – by Product Type, Drug Type, Route Of Administration, Therapeutic Area, And Distribution Channel,” the prescription drugs market size was valued at US$ 1,440.79 billion in 2024 and is projected to reach US$ 2,350.12 billion by 2031. The market is expected to register a CAGR of 7.3% during 2025–2031. Major factors driving the prescription drugs market growth include the increasing prevalence of chronic disorders and the rising innovation and adoption of specialty drugs. Additionally, growth of personalized and precision medicine are expected to bring new prescription drugs market trends in the near future.

Prescription drugs are medications that legally require a medical prescription from a licensed healthcare professional. These drugs have significant effects on the body, require monitoring for safety, and have potential for misuse.

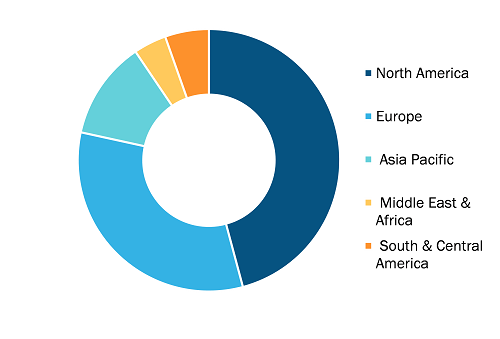

Prescription Drugs Market, by Region, 2024(%)

Prescription Drugs Market Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Product Type (Branded and Generics), Drug Type (Small Molecule and Biologics and Biosimilar), Therapeutic Area (Oncology, Cardiovascular Diseases, Neurological Diseases, Metabolic Diseases, Respiratory Diseases, Immunology, and Others), Route Of Administration (Oral, Injectable, Topical, and Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Prescription Drugs Market Research – Size, Share, Developments and Future Scope 2031

Download Free Sample

Source: The Insight Partners Analysis

Prescription Drugs Market Analysis Based on Segmental Evaluation:

Based on product type, the prescription drugs market is bifurcated into branded and generics. In 2024, the branded segment held a significant prescription drugs market share. Branded drugs are developed through extensive research, requiring significant investment in clinical trials, regulatory approvals, and commercialization. Pharmaceutical companies prioritize branded drug development to introduce novel treatments, address unmet medical needs, and secure long-term revenue streams through patent protection and market exclusivity. Branded prescription drugs encompass a wide array of product types, including small molecules, biologics, and biosimilars. For instance, Humira (adalimumab) (developed by AbbVie) is a monoclonal antibody used to treat autoimmune diseases such as rheumatoid arthritis and Crohn’s disease. It was one of the top-selling branded drugs globally, generating ~US$ 20.4 billion in sales in 2020.

Substantial investments in research and development propel the branded pharmaceuticals sector as leading companies prioritize innovation in biologics, precision medicine, and breakthrough therapies for chronic and rare diseases, strategic mergers and acquisitions, and the integration of advanced technologies. As per the Pharmaceutical Technology, Pfizer's acquisition of Seagen for US$ 43 billion in 2023 significantly enhanced Pfizer's oncology portfolio with Seagen's innovative antibody-drug conjugate technology. Additionally, as per Reuters, AstraZeneca's agreement to acquire EsoBiotec for up to US$ 1 billion in March 2025 aims to bolster its cell therapy capabilities, particularly in cancer and autoimmune diseases. In 2023, Merck & Co. led global spending on research and development with US$ 30.53 billion, reflecting its focus on oncology, immunology, and vaccines, while Johnson & Johnson, Roche, and Novartis maintained strong investments to advance their drug pipelines. The growing demand for targeted therapies, mRNA technology, and AI-driven drug discovery has driven companies such as AstraZeneca, Pfizer, and Eli Lilly to allocate substantial resources toward research. These strategic moves underscore the industry's commitment to expanding therapeutic offerings and embracing precision medicine.

The adoption of digital health technologies and artificial intelligence is streamlining drug discovery and development processes, enhancing efficiency, and reducing time-to-market. Regulatory agencies have also introduced accelerated approval pathways to expedite the launch of breakthrough therapies, particularly in oncology, neurology, and rare diseases, reflecting a dynamic environment that continues to evolve with scientific advancements and strategic collaborations. As the branded drug market continues to evolve, companies navigate a delicate equilibrium between innovation, cost-effectiveness, and long-term market viability. Organizations that adeptly align with shifting industry dynamics, invest strategically in advanced research and development, and proactively address global healthcare challenges will remain at the forefront of medical innovation.

The scope of the prescription drugs market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, and the Middle East and Africa. In terms of revenue, North America dominated the prescription drugs market share in 2024. As the baby boomer generation grows older, the prevalence of chronic diseases has increased, thereby boosting the demand for prescription medications. The US holds a significant share of the prescription drugs market in North America. In the US, chronic conditions such as cancer, heart disease, and diabetes are contributing to the rising demand for prescription medications. Heart disease remains the leading cause of death in the US, with ~1 million Americans annually succumbing to cardiovascular disease (CVD). According to the American Heart Association, nearly half of the total number of adults in the US have a CVD, and the number of adults suffering from heart failure is estimated to increase by 2035. Over 130 million adults, i.e., 45.1% of the US population, are expected to report a CVD by 2035. This surge in CVD cases leads to a higher number of patients requiring long-term medication management, including statins, beta-blockers, anticoagulants, and antihypertensive drugs.

According to the American Cancer Society, in 2022, ~1.9 million new cancer cases were diagnosed in the country, and it caused ~0.61 million deaths. With the increasing cases of cancer, the demand for innovative treatment options is rising. Therapeutic vaccines offer promising alternatives to traditional therapies. Provenge (sipuleucel-T), approved by the FDA in 2010, was the first therapeutic cancer vaccine to receive approval and was prescribed for cancer treatment. Additionally, advancements in oncology, immunology, and gene therapies are expanding treatment options for various cancers and autoimmune diseases. According to the American Society of Health-System Pharmacists, in 2024, Americans spent US$ 805.9 billion on prescription drugs, which is a 10.2% increase from the previous year. This rise is attributed to a higher demand for these medications and the introduction of new, expensive treatments. Additionally, 79% of Americans believe that prescription drug prices are unreasonable, while 70% consider reducing these costs to be their top healthcare priority. According to the Rand Corporation, prescription drug prices in the US are 2.56 times higher on average than those in 32 other Organization for Economic Co-operation and Development (OECD) countries, with brand-name medications costing 3.44 times more. To address these costs, the Inflation Reduction Act (IRA), which aims to negotiate drug prices for Medicare, was introduced. In 2024, the US government finalized prices for the first ten drugs under the IRA 2022, marking a significant milestone. After months of negotiations with drug manufacturers, prices for medications such as Stelara and Jardiance have been reduced by 38% to 79%. These changes are anticipated to save taxpayers US$ 6 billion by 2026 and provide US$ 1.5 billion in savings for patients.

While spending continues to rise, legislative efforts are underway to make medications more affordable for Americans. In May 2025, President Donald Trump signed an executive order titled “Delivering Most-Favored-Nation Prescription Drug Pricing to American Patients.” Trump stated that the order aims to align the prices Americans and taxpayers pay for prescription drugs with those paid in comparable countries. The measure is expected to cut drug prices by at least 50% and is characterized as a more aggressive version of Trump’s 2020 Most Favored Nation model driving the prescription drugs market growth.

Johnson & Johnson; Pfizer Inc; Merck & Co Inc; Eli Lilly and Co; ESTEVE; AstraZeneca Plc; Sanofi SA; GSK Plc; F. Hoffmann-La Roche; Novartis AG; AbbVie Inc; Teva Pharmaceutical Industries Ltd are among the leading companies profiled in the prescription drugs market report.

Based on product type, the prescription drugs market is bifurcated into branded and generics. By drug type, the prescription drugs market is bifurcated into small molecule and biologics and biosimilar. In terms of therapeutic area, the prescription drugs market is segmented into oncology, cardiovascular diseases, neurological diseases, metabolic diseases, respiratory diseases, immunology, and others. Based on route of administration, the prescription drugs market is segmented into oral, injectable, topical, and others. By distribution channel, the prescription drugs market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Geographically, the market is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com