$4450

$3560

The refrigerant market size is projected to reach US$ 75.62 billion by 2031 from US$ 47.07 billion in 2024. The market is expected to register a CAGR of 7.0% during 2025–2031.

Refrigerant Market AnalysisStrict rules such as the Kigali Amendment and phasedowns of F-gas are hastening the process of replacing high-GWP HFCs with low-GWP HFOs, blends of HFOs and HFCs, and natural refrigerants, including CO2, ammonia, and hydrocarbons. Volume is increasing in APAC due to rapid urbanization, improved living standards, growth of cold-chain logistics, the explosion of data centers, and the adoption of electric-based vehicles. The new generation of leak detection, reclamation systems, and equipment that is compatible with A2L allows safer transitions without compromising the performance, cost, and reliability of its usage in residential, commercial, industrial, and automotive applications.

Refrigerant Market OverviewThe universal requirement of refrigeration, air conditioning, and heat-pump systems that provide performance and fulfill the environmental requirements. The installed base is yet to be overcome by HFOs (R-1234yf, R-1234ze), R-32, and natural alternatives. Asia Pacific has been the most active in consumption and production based on the hot climates, urbanization, and industrialization in China and India. The best transitions are imposed in Europe and North America because of stringent laws, whereas developing countries compromise between costs and gradual compliance. By creating more eco-friendly refrigerants, improving how cooling systems are designed, and recycling old refrigerants properly, companies can keep improving their products and stay compliant with laws in the future.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Refrigerant Market: Strategic Insights

Market Size Value in US$ 16,458.3 Million in 2021 Market Size Value by US$ 25,534.6 Million by 2028 Growth rate CAGR of 6.5% from 2021 to 2028 Forecast Period 2021-2028 Base Year 2021

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Refrigerant Market Drivers and OpportunitiesCustomize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Refrigerant Market: Strategic Insights

| Market Size Value in | US$ 16,458.3 Million in 2021 |

| Market Size Value by | US$ 25,534.6 Million by 2028 |

| Growth rate | CAGR of 6.5% from 2021 to 2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Drivers:

- Demand has been rising, especially in air conditioning and refrigeration: Urbanization and increasing incomes in the Asia Pacific and the Middle East drive intensive residential, commercial, and automotive cooling owing to the hot climate.

- Strict environmental standards: Kigali Amendment, EU F-Gas legislation, as well as national phasedowns of HFC require low-GWP substitutes.

- Boom in the use of electric vehicles and data centers: The use of heat pumps and precision cooling systems is growing rapidly, leading to greater use of refrigerant.

Market Opportunities:

- The next generation low-GWP solutions: HFOs (R-1234yf/ze), A2L blends, and natural refrigerants have high-growth replacement potential.

- Growing Asia-Pacific countries: Sluggish phasedown schedules and new plants propel demand for transitional and low-GWP refrigerants.

- Reclamation, recycling, and circular economy: Advanced recovery and reclaimed refrigerant markets help in ensuring sustainability and cost reduction.

The refrigerant market is divided into different segments to give a clearer view of its growth potential and the latest trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Ammonia: It is a highly efficient natural refrigerant that has zero GWP; the most commonly used in large, industrial-based refrigeration systems, though it is toxic.

- Carbon Dioxide: Natural refrigerant (GWP 1) is eco-friendly and is rapidly replacing other refrigerants in supermarkets, heat pumps, and in trans critical commercial systems.

- Propane: Hydrocarbons with a high efficiency (GWP 3) will be used in small commercial units, vending machines, and plug-in cabinets.

- Isobutane: Extremely low GWP hydrocarbon; it is standardized in the domestic refrigerators and freezers worldwide because it conserves energy.

- HFCs: Large-volume, old refrigerants (R-410A, R-134a, R-404A) continue to prevail in existing systems but are being phased down worldwide.

- HFOs: HFC Replacements in automotive and commercial AC Next-generation low-GWP synthetics (R-1234yf, R-1234ze, A2L blends); the most rapidly growing ones to replace HFCs.

- Others: Transitional blends (R-448A/R-449A, R-407 series), niche naturals, and emerging which are primarily involved in retrofits and special use.

By Application:

- Refrigeration Systems

- Chillers

- Air Conditioning Systems

- MACs

- Others

By End Use:

- Industrial

- Commercial

- Residential

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South & Central America

Market Report Scope

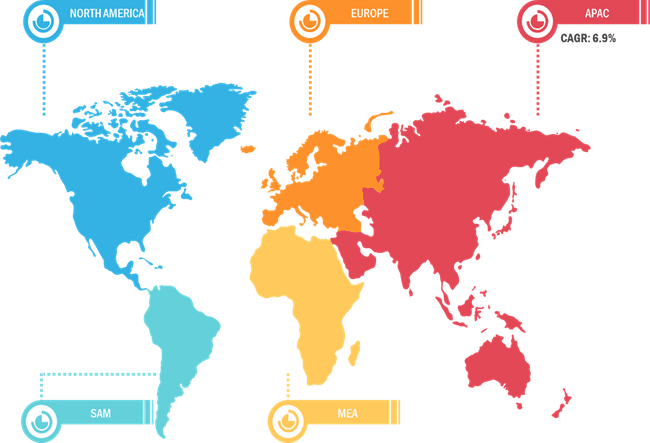

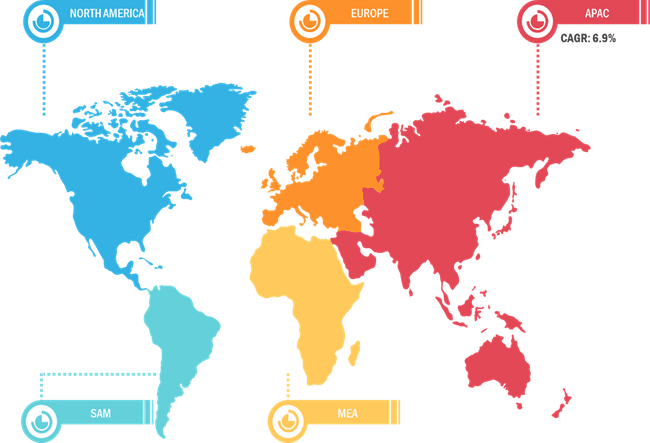

Refrigerant Market Share Analysis by GeographyRapid urbanization, increasing incomes, and hot climates create huge demand for air conditioning, cold-chain development, and refrigeration systems, which boosts the consumption of refrigerants. New markets in Latin America and MEA have a good future development potential due to food retail modernization, frozen exports, and a late HFC phasedown schedule.

The refrigerant market growth differs in each region due to the rate of economic development and consumer preferences. Below is a summary of market share and trends by region:

1. North America

- Market Share: Controls a considerable portion of the refrigerants market

- Key Drivers:

- Commercial refrigeration and residential AC penetration.

- No lenient EPA HFC phasedown and low-GWP requirements

- Trends: Rapid conversion to A2L HFO blends and CO2 cascade systems

2. Europe

- Market Share: Large share stimulated by early and aggressive regulation

- Key Drivers:

- Tough EU F-Gas quotas and 2030 HFC bans.

- Good supermarket and heat pump adoption

- Trends: The adoption of natural refrigerants (CO2, propane ) and HFO leadership

3. Asia Pacific

- Market Share: The fastest-growing region with a rapidly increasing market share

- Key Drivers:

- Massive AC power demands, urbanization, and cold-chain development.

- HFC production and consumption in China/India

- Trends: Ongoing HFC consumption and increasing use of R-32 and HFO/HFC mixture

4. Middle East and Africa

- Market Share: Expanding market with stable growth

- Key Drivers:

- AC and refrigeration demand due to extreme climate.

- Late Phase down in Art 5 countries.

- Trends: High demand for low-cost HFC and blends

5. South and Central America

- Market Share: Smaller and fast-growing market

- Key Drivers:

- Cold-chain development in food and retail export.

- Progress in AC intrusion and regulatory correlation with Kigali

- Trends: Replacement of R-404A/R-22 with lower-GWP HFO solutions and replacement of R-290/R-600a solutions with lower-GWP HFO solutions.

High Market Density and Competition

Competition is intense due to the presence of established players such as Archer-Daniels-Midland Company, Didion Milling Inc, KRONER-STÃRKE GmbH, Tardella Flour Co Inc, and LifeLine Foods LLC.

This high level of competition urges companies to stand out by:

- Future innovation to create next-generation low-GWP HFOs, A2L blends, and natural refrigerant solutions with a higher level of efficiency and safety.

- Communicating cost-efficient, drop-in, and retrofit blends to prolong the use of the already in place HFC systems and conform to the phasedown schedules.

- The offer of advanced reclamation, recovery, and circular economy services to cut the virgin refrigerant demand and emissions.

Opportunities and Strategic Moves

- Introduce new equipment based on ultra-low GW PHFO and natural refrigerant portfolios.

- Increase the production of R-32 and R-454 mixtures and R-1234yf/ze to win out replacement market.

- Inventory leak detectors, IoT monitoring, and smart fridge systems.

- Collaborate with OEMs on A2L- and CO2 -CO2-compatible equipment.

- Co-operate with governments and industry in the training, safety standards, and the large-scale reclamation programs.

- A-Gas International Limited

- Eastman Chemical Co

- Eastman Chemical Co

- Arkema SA

- Linde Plc

- Honeywell International Inc

- Daikin Industries Ltd

- Air Liquide

- Orbia

- Quimobasicos SA de CV

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during research:- Didion Milling Inc

- KRONER-STÃRKE GmbH

- Tardella Flour Co Inc

- LifeLine Foods LLC

- Sage V Foods LLC

- Agrasys S.L.

- Caremoli Group

- BELOURTHE S.A

- A-Gas Expands Operations in Canada: A-Gas International Limited established its first Canadian refrigerant recovery and reclamation facility in Hamilton, Ontario. The facility, operational by the fourth quarter of the year, processed and reclaimed refrigerants to AHRI-700 standards.

- Arkema strengthens its range of lower global warming: Arkema SA announced an expansion of its low-GWP refrigerant offerings through a commercial partnership with Honeywell. This collaboration aims to enhance global supply chains and meet the growing demand for HFO blends in the HVACR industry, aligning with the HFC phasedown.

The " Refrigerant Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Refrigerant market size and forecast at global, regional, and country levels for all market segments covered under the scope

- Refrigerant market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's five forces analysis and SWOT analysis

- Refrigerant market analysis covering market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the refrigerant market

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

A-Gas International Limited, Eastman Chemical Co, Eastman Chemical Co, Arkema SA, Linde Plc, Honeywell International Inc, Daikin Industries Ltd, Air Liquide, Orbia, and Quimobasicos SA de CV are among the key players operating in the market.

Asia Pacific dominated the refrigerant market in 2024.

The market size is projected to reach US$ 75.62 billion by 2031.

Accelerated transition to ultra-low GWP solutions, resurgence of natural refrigerants, reclosable, and rise of reclamation and circular economy practices are likely to emerge as key trends in the refrigerant market in the future.

Rising demand, especially in air conditioning and refrigeration, strict environmental standards, and a boom in the use of electric vehicles and data centers are major factors driving the growth of the refrigerant market.

The List of Companies - Refrigerants Market

- The Chemours Company

- Dongyue Group Limited

- SRF Limited

- Gujarat Fluorochemicals Limited

- AGC Inc

- Sinochem Group

- Shandong Yuean Chemical

- Zhejiang Sanmei Chemical

- Changshu 3F Zhonghao

- Zhejiang Fotech International

- Navin Fluorine International

- Harp International Ltd.

- Tazzetti S.p.A.

- Shandong Dongyue Chemical

- Jiangsu Meilan Chemical

- Zhejiang Juhua Co., Ltd.

- Weitron Inc.

- Gas Servei S.A.

- Shandong Huaan New Material

- Zhejiang Yonghe Refrigerant

- Mexichem Fluor (Koura)

- Srf Fluorochemicals

- Zhejiang Quzhou Lianzhou Refrigerants

- Puyang Shengda Chemical

- Changzhou Kangmei Chemical

- Luxi Chemical Group

- Zibo Feiyuan Chemical

- Shandong Hua Lu Hengsheng

- Hychill Australia

- Refrigerant Solutions Ltd.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Refrigerant Market

Dec 2025

Ester for Synthetic and Bio-Based Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Ester Type [Monoesters, Diesters, Polyol Esters (Trimethylolpropane Esters, Pentaerythritol Esters, Neopentyl Glycol Esters, Trimethylol Ethane Esters, and Dipentaerythritol Esters), Trimellitate Esters, Complex Esters, and Others], Lubricant Type (Synthetic Lubricants and Biobased Lubricants), Application [Engine Oil (MCO, PCMO, HDEO, and Other Engines), Compressor Oil, (Refrigeration, Air Compressors, Natural Gas Compressors, and Others Compressors), Hydraulic Fluids, Gear Oil, Transmission Oil, Coolants, and Others], and End Use [Automotive (Conventional Vehicles and Electric Vehicles), Textile, Marine, Mining and Metallurgy, Aviation, Energy and Power, and Others]

Dec 2025

Synthetic Ester Lubricants for Electrical and Electronics Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Metalworking Fluids, and Others) and End Use (General Air Conditioners, Automotive Air Conditioners, Refrigerators, and Others)

Dec 2025

Synthetic Ester Lubricants for Construction Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Grease, Turbine Oil, Metalworking Fluids, and Others) and End Use (Construction Machinery, Concrete and Construction Tools, Wire Ropes and Chains, and Others)

Dec 2025

Synthetic Ester Lubricants for Energy and Power Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Turbine Oil, Metalworking Fluids, and Others) and End Use (River Dam, Offshore Wind Power, Energy Storage Systems, and Others)

Dec 2025

Aviation Synthetic Ester Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Transformer Oil, Refrigeration Oil, Grease, Turbine Oil, Metalworking Fluids, and Others), End Use (Commercial Aircraft, Military Aircraft, Spacecraft/Satellites, Drone and UAV, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2025

Marine Synthetic Ester Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Engine Oil, Hydraulic Oil, Gear Oil, Transformer Oil, Refrigeration Oil, Grease, Turbine Oil, and Others], and End Use [Cargo Ships, Passenger Ships, Naval Vessels (Military End Uses), Offshore Support Vessels, Fishing and Leisure, Port Equipment, and Others], and Geography [North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America]

Dec 2025

Automotive Synthetic Ester Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil [MCO, PCMO, HDEO, and Others], Hydraulic Oil, Gera Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Metalworking Fluids, and Others), End Use (Conventional Vehicles and Electric Vehicles), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2025

Steel Sandwich Panel Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Core Material (Polyisocyanurate and Mineral Wool), Application (Wall Panels, Roof Panels, and Others), and End Use (Residential, Commercial, Industrial, Institutional, and Infrastructure)