$4450

$3560

The Robotics Lubricants Market size is projected to reach US$ 14.24 billion by 2031 from US$ 6.92 billion in 2024. The market is expected to register a CAGR of 11.0% during 2025–2031.

Robotics Lubricants Market Analysis

The robot lubricants industry is rising with the increasing use of automation in manufacturing, logistics, health, and service industries. With the growing use of robotics in sectors to enhance efficiency, labor cost, and consistency in production, there is a corresponding increase in the demand for high-performance lubricants. Precision and reliability of robotic systems require a specific lubrication to run appropriately and avoid wear of their components, mainly when used in continuous or high-speed mode. Moreover, the development of high-level robotics, such as collaborative robots and mobile automation, is providing new applications with defined lubrication requirements. Moreover, increasing investments in smart factories are contributing to the growth of the market, as companies are interested in special lubricants that may be integrated with monitoring systems. Environmental and safety laws are also pushing toward the creation of more eco-friendly and sustainable lubricant solutions, which further widens the market.Robotics Lubricants Market Overview

Robotic lubricants are special oils or greases that are designed to minimize friction, wear, and heat in robotic components such as gears, joints, actuators, and bearings. Such lubricants play a vital role in ensuring smooth and accurate operations of the robotic systems, particularly when working around the clock or when the machines are under mechanical pressure. In contrast to general-purpose lubricants, robotic lubricants are engineered to work consistently at high temperatures, at variable speeds, and in locations that demand nontoxic, low-residue, or cleanroom-friendly lubricants. They assist in increasing the life cycle of the robotic components, reducing maintenance requirements, and maintaining the same performance over time. With the growing demand for automation, robotic lubricants are essential in ensuring industrial, commercial, and service uptime optimization, accuracy, and equipment protection.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Robotics Lubricants Market: Strategic Insights

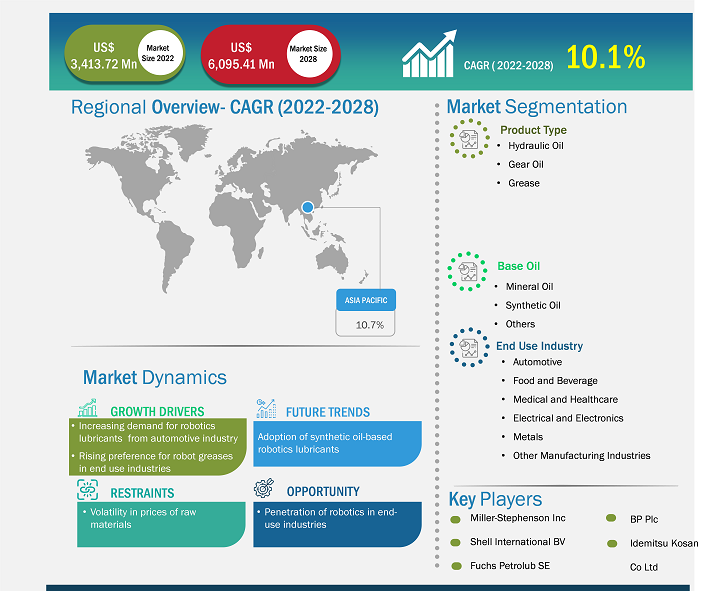

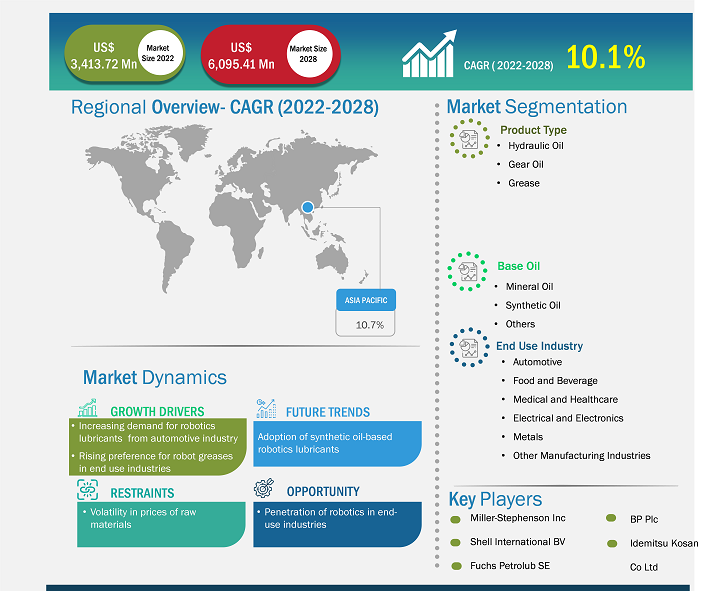

Market Size Value in US$ 3,413.72 million in 2022 Market Size Value by US$ 6,095.41 million by 2028 Growth rate CAGR of 10.1% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2021

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Robotics Lubricants Market Drivers and Opportunities

Speak to Analyst

Robotics Lubricants Market Drivers and Opportunities

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Robotics Lubricants Market: Strategic Insights

| Market Size Value in | US$ 3,413.72 million in 2022 |

| Market Size Value by | US$ 6,095.41 million by 2028 |

| Growth rate | CAGR of 10.1% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2021 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Drivers:

Industrial Automation Development:

Favorable government initiatives supporting the development of industrial automation across various industries.

Rising Equipment Lifespan Requirements:

Rising demand for increased lifespan of equipment requires a demand for high-performing lubricants.

Advanced Robotics Technology:

The development of advanced robotics technology aiming to automate manufacturing drives the demand for robotic lubricants.

Growth of Clean and Controlled Environments:

Rising demand in food processing, pharmaceuticals, and medical manufacturing is providing a demand to utilize nontoxic lubricants that are cleanroom-friendly and under strict safety and hygiene standards.

Market Opportunities:

Development of Bio-Based Lubricants:

Rising environmental concerns create opportunities for bio-based lubricants.Customized Formulations for Niche Applications:

Rising demand for application-specific lubricants on collaborative robots, service robots, and AGVs, where safety, low residue, and specialty performance are paramount.Expansion into Emerging Markets:

As the smart manufacturing trend is growing in emerging markets, such as South & Central America and Southeast Asia, the demand for robotic lubricants is expected to increase.

Robotics Lubricants Market Report Segmentation Analysis

The robotics lubricants market is segmented to give a broad view of market growth potential and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product Type:

Hydraulic Oil:

It is used in robotic lubricants for precise control movements in automated systems.Gear Oil:

Gear Oil is used to reduce friction and improve performance under extreme conditions.Grease:

A semi-solid lubricant that is applied in robot joints and bearings where the lubricant needs to last long and be highly maintenance-free.Dry Lubricants:

It helps reduce friction and wear in the joints and bearings of the robotic components.Solid Lubricants:

It is used during extreme conditions and high temperatures to reduce friction in robotic systems.

By Base Oil:

Mineral Oil:

A base oil that is petroleum-based and is used in standard lubricant formulations that provide basic performance in general-purpose robotic applications.Synthetic Oil:

These are highly stable in thermal conditions, resistant to oxidation, and enhance the service life of high-performance robotic systems.Others:

These include bio-based, ester-based, or specialty fluids that reduce friction.

By Component:

Gears and Gearboxes:

Lubricants, when applied to gears and gearboxes, reduce friction and wear and tear by preventing overheating.Bearings:

Lubricants are used in bearings to ensure precise movements by reducing resistance and overheating.Drive Chain and Belts:

Lubricants prevent corrosion, wear, and misalignment of moving chains and belts in dynamic robotic systems.Reducers:

Lubricants are applied to speed-reducing elements with high load-carrying capacity requirements.Others:

These include actuators, seals, or linear guides, which need specific lubrication solutions to perform and last.

By Robot Type:

Industrial Robots:

Using high-performance lubricants supports continuous and high-speed operations in manufacturing and assembly facilities.Collaborative Robots:

Clean and bio-based lubricants are needed that are safe in shared human-robot workspaces and provide mechanical precision.Service Robots:

Use special lubricants that operate quietly, leave little residue, and are reliable in the public or commercial environment.Humanoid Robots:

Lightweight, flexible lubrication solutions are required to enable complex and human-like movements and multiple-joint articulation.Others:

Niche robots, such as medical, underwater, or defense robots, are also included, and each demands a specific lubrication to work within a particular environment.

By End Use Industry:

Automotive:

Applies robotic lubricants to high-speed assembly and welding robots to provide precision, reliability, and long service life.Food and Beverage:

Needs food-grade, nontoxic lubricants on robots in hygienic and contamination-sensitive areas.Medical and Healthcare:

Requires surgical robots and automated medical equipment lubricants that are cleanroom-compatible and low-emission.Electrical and Electronics:

Uses specialty lubricants on cleanroom robots that deal with sensitive parts in a static and dust-sensitive environment.Metals:

This industry uses heavy-duty lubricants in robots that cut, weld, forge, and handle abrasive materials under extreme work environments.Others:

This includes industries such as logistics, aerospace, and the pharmaceutical sectors, which use automation.

By Geography:

- North America

- Europe

- Asia Pacific

- South and Central America

- Middle East & Africa

The robotics lubricants market in Asia Pacific is expected to grow fastest. A growing demand from end-use industries in the region powers this surge.

Robotics Lubricants Market Report ScopeRobotics Lubricants Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in South and Central America, the Middle East, and Africa also have many untapped opportunities for robotics lubricants providers to expand.

The robotics lubricants market grows differently in each region. The demand for smart manufacturing continues to grow, positioning robotics lubricants as a favored treat globally, in an evolving consumer landscape. Below is a summary of market share and trends by region:

1. North America

Market Share:

Holds a significant portion of the global marketKey Drivers:

- Increasing adoption of smart manufacturing in various industries.

- Strong focus on predictive maintenance and performance optimization.

Trends:

Growing demand for smart lubricants integrated with condition-monitoring technologies to support data-driven maintenance strategies.

2. Europe

Market Share:

Holds a significant market shareKey Drivers:

- Stringent environmental regulations encourage the use of eco-friendly, low-emission lubricants.

- Advanced manufacturing infrastructure.

Trends:

Shift toward bio-based and biodegradable lubricants driven by EU sustainability goals.

3. Asia Pacific

Market Share:

Dominated the market and is also the fastest-growing region, with a rising market share every yearKey Drivers:

- Large-scale industrial manufacturing.

- Government-led initiatives across the region.

Trends:

Rising domestic production of robots is fuelling local demand for region-specific lubricants.

4. Middle East and Africa

Market Share:

A growing market with significant progressKey Drivers:

- Increasing investment in industrial diversification.

- Rising infrastructure development.

Trends:

Growing automation in manufacturing across industries.

5. South and Central America

Market Share:

Although small, it is growing quicklyKey Drivers:

- Expansion of the automotive assembly and food processing industries.

- Cost-driven automation adoption.

Trends:

Emerging interest in sustainable and low-maintenance lubricant products.

Robotics Lubricants Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to established players such as Petrelplus Inc., Shell Plc., Fuchs SE, BP Plc., TotalEnergies SE, and Idemitsu Kosan Co Ltd, adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Innovative product offering

- Sustainable and ethical sourcing

- Competitive pricing models

- Strong customer support and easy integration

Opportunities and Strategic Moves

- Focusing on research and development activities to distinguish themselves in the market.

- Expanding global footprint and capabilities through acquisitions of value-added confectionery brands.

- Expanding product portfolio with the launch of several baked goods and confectionery products.

Major Companies operating in the Robotics Lubricants Market are:

- Petrelplus Inc

- Shell Plc

- Fuchs SE

- BP Plc

- TotalEnergies SE

- Idemitsu Kosan Co Ltd

- Matrix Specialty Lubricants B

- Chemie-Technik GmbH

- Quaker Chemical Corp (Quaker Houghton)

- Chevron Corp

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Citgo Petroleum Corp

- The Chemours Co

- Valvoline Inc

- Miller-Stephenson Inc

- Petroliam Nasional Bhd

- Castrol Limited

- Molygraph

- Powermaxx Lube India

- Nabtesco Precision Europe GmbH

- GreaseDivision

Robotics Lubricants Market News and Recent Developments

METALUBE. – Product Launch

In 2024, METALUBE launched the next-generation food-safe NSF-registered high-performance chain oils. The new products are designed to increase overall equipment effectiveness due to higher thermal stability, reduced carbon and varnish deposits, and optimized performance-enhancing additives.Shell plc. – Product Launch

In 2024, Shell Lubricants introduced three new products in its market-leading Shell Helix Ultra passenger car motor oil brand to meet higher industry specifications and original automotive manufacturer (OEM) specifications to allow customers to unlock more engine power.PETRONAS Lubricants International (PLI). – Product Launch

In 2024, ETRONAS Lubricants International (PLI), in partnership with Stellantis N.V., launched its new line of lubricants, the co-branded Selenia SUSTAINera engine oils.

Robotics Lubricants Market Report Coverage and Deliverables

The "Robotics Lubricants Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Robotics Lubricants Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Robotics Lubricants Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's five forces and SWOT analysis

- Robotics Lubricants Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Robotics Lubricants Market

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Base Oil, Product Type, and End Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific dominated the market with the largest share in 2024.

Emerging interest in bio-based lubricants is likely to bring new trends in the market.

The market size is projected to reach US$ 14.24 billion by 2031.

Petrelplus Inc., Shell Plc, Fuchs SE, BP Plc, TotalEnergies SE, Idemitsu Kosan Co., Ltd, Matrix Specialty Lubricants BV, Chemie-Technik GmbH, Quaker Chemical Corp (Quaker Houghton), Chevron Corp, Citgo Petroleum Corp, The Chemours Co., Valvoline Inc., Miller-Stephenson Inc., and Petroliam Nasional Bhd are among the key players operating in the market.

Rising demand for automation across various end-use industries and rising investments in smart manufacturing contribute to market growth.

The List of Companies - Robotics Lubricants Market

- Petrelplus Inc

- Shell Plc

- Fuchs SE

- BP Plc

- TotalEnergies SE

- Idemitsu Kosan Co Ltd

- Matrix Specialty Lubricants B

- Chemie-Technik GmbH

- Quaker Chemical Corp (Quaker Houghton)

- Chevron Corp

- Citgo Petroleum Corp

- The Chemours Co

- Valvoline Inc

- Miller-Stephenson Inc

- Petroliam Nasional Bhd

- Castrol Limited

- Molygraph

- Powermaxx Lube India

- Nabtesco Precision Europe GmbH

- GreaseDivision

- Castrol Limited

- Molygraph

- Klüber Lubrication München GmbH & Co. KG

- Santie Oil Company

- Vigo Grease

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Robotics Lubricants Market

Sep 2025

Crude Steel Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Product Type (Plates, Tubes, Bars, Wire Rod, and Others), Manufacturing Process (Basic Oxygen Furnace and Electric Arc Furnace), and End-Use Industry (Building and Construction, Automotive, Industrial Machinery, Energy and Power, Consumer Goods, Marine, Oil and Gas, and Others)

Sep 2025

Americas, Europe, and Asia Pacific Ester for Synthetic and Bio-Based Lubricants Market

Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Ester Type [Monoesters, Diesters, Polyol Esters (Trimethylolpropane Esters, Pentaerythritol Esters, Neopentyl Glycol Esters, Trimethylol Ethane Esters, and Dipentaerythritol Esters), Trimellitate Esters, Complex Esters, and Others], Lubricant Type (Synthetic Lubricants and Biobased Lubricants), Application [Engine Oil (MCO, PCMO, HDEO, and Other Engines), Compressor Oil, (Refrigeration, Air Compressors, Natural Gas Compressors, and Other Compressors), Hydraulic Fluids, Gear Oil, Transmission Oil, Coolants, and Others], and End Use [Automotive (Conventional Vehicles and Electric Vehicles), Textile, Marine, Mining and Metallurgy, Aviation, Energy and Power, and Others]

Sep 2025

Amorphous Silica Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Grade (High-Purity, Medium-Purity, and Low-Purity), Product Type (Precipitated Silica, Silica Gel, Colloidal Silica, Fumed Silica, and Others), Application (Rubber, Electrical and Electronics, Building and Construction, Personal Care and Cosmetics, Food and Beverages, Oil and Gas, Pulp and Paper, Agrochemicals, and Others), and Geography

Sep 2025

Leather for Automotive Seats Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Genuine Leather and Artificial Leather (Polyurethane, Polyvinyl Chloride, and Others)], Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others), and Geography

Sep 2025

Leather for Aviation Application Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Genuine Leather and Artificial Leather (Polyurethane, Polyvinyl Chloride, and Others)], Application [Seats, Headrests, Armrests, Cushions, Cabin Interiors, and Others], Aircraft Type [Private Aircraft, Commercial Aircraft, Military Aircraft, and Others], and Geography

Sep 2025

Leather for Railway Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Genuine Leather and Artificial Leather [Polyurethane, Polyvinyl Chloride, and Others]), Application (Train Seats, Traction Bellows, Handle and Grip Bars, Cushions and Pillows, and Others), Train Type (Passenger Trains, Freight Trains, Mining Trains, and Others), and Geography

Sep 2025

Insect Pest Control Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Insect Type (Termites, Cockroaches, Bedbugs, Mosquitoes, Ants, Flies, and Others), Form (Dry and Liquid), Control Method (Chemical, Biological, and Physical), Category (Synthetic and Herbal/Natural), and End User (Residential/Household, Commercial Facilities, Animal Husbandry, Industrial, and Crop Protection)

Sep 2025

Re-Refined Paraffinic Base Oil Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Process (Acid Treatment, Clay Treatment, Solvent Extraction, and Hydrotreating), Application (Engine Oil, Hydraulic Oil, Metalworking Fluid, Compressor Oil, Grease, Turbine Oil, and Others), End Use (Automotive, Construction, Mining and Metallurgy, Marine, Energy and Power, Oil and Gas, and Others), and Geography