Expanding Aviation Industry Bolsters Leather for Aviation Application Market Growth

According to our latest study on "Leather for Aviation Application Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – type, application, and aircraft type," the market size is expected to grow from US$ 6.20 billion in 2024 to US$ 8.28 billion by 2031; the market is estimated to register a CAGR of 4.4% from 2025 to 2031. The report highlights key factors driving the leather for aviation application market growth and prominent players along with their developments in the market. Apart from the growth drivers, the report covers the leather for aviation application market trends and their foreseeable impact during the forecast period.

The increasing number of tourism activities and international business connections is creating pressure on the aviation industry to improve passenger comfort and aircraft design. As global air travel grows worldwide, airlines and aircraft manufacturers are being highly prioritized for passenger comfort, aesthetics, and safety, surging the use of high-quality leather for seating, upholstery, and cabin accessories. According to International Air Transport Association (IATA) data from January 2025, the international air traffic in 2024 (measured in revenue passenger kilometers, or RPKs) increased 10.4% from 2023. This total capacity is measured in available seat kilometers (ASK), which increased by 8.7% in 2024. International full-year traffic in 2024 reached 13.6% compared to 2023, while capacity increased 12.8%. Below is the table that represents the worldwide air passenger market in 2024.

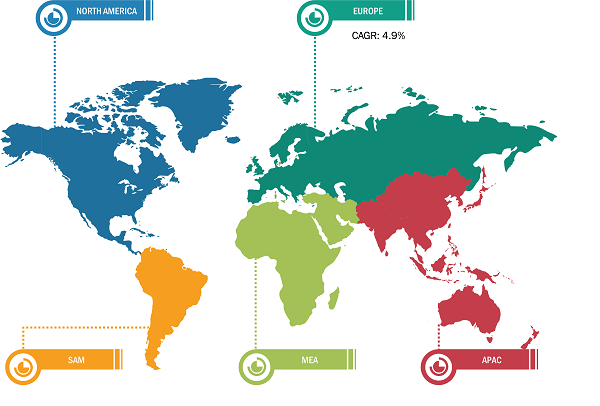

Leather for Aviation Application Market Breakdown – by Region

Leather for Aviation Application Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Genuine Leather and Artificial Leather (Polyurethane, Polyvinyl Chloride, and Others)], Application [Seats, Headrests, Armrests, Cushions, Cabin Interiors, and Others], Aircraft Type [Private Aircraft, Commercial Aircraft, Military Aircraft, and Others], and Geography

Leather for Aviation Market Report | Growth & Size by 2031

Download Free Sample

According to the IATA, in 2025, there was a 10.4% increase in total demand for domestic and international travel. Airlines addressed the high demand with new efficiency. On average, 83.5% of all available seats were filled with passengers. This expansion creates demand for new fleets to improve overall customer satisfaction. The manufacturing of the new fleet surges the adoption of leather for developing superior, durable, high-quality, and comfortable seats, headrests, armrests, cushions, and other cabin interiors.

Moreover, the expansion of aircraft capacity and the development of a new fleet increases the demand for leather to enhance the overall passenger experience. According to Boeing, the fleet size is expected to grow by 2.8% between 2022 and 2041, with the delivery of ~41,170 aircraft. These aircraft are procured by different airlines to meet their increased air passenger demand. Thus, expanding the aviation industry, growing air passenger traffic, and increasing the number of aircraft contribute to the leather for aviation application market share globally.

Vegan leather, also known as faux leather, is a synthetic material that looks and feels similar to leather made from animals. Vegan leather is an eco-friendly and cruelty-free alternative to regular leather. It is made from plant-based materials such as pineapple leaves, apple peels, and mushrooms, as well as synthetic polymers. Plant-based materials are gaining popularity worldwide owing to their sustainable properties. These materials are made from biodegradable organic resources, making them attractive to environmentally conscious consumers and the aviation industry. The aviation sector uses vegan leather for manufacturing and designing aircraft seat upholstery, headrests, and other interior components. Its lightweight design contributes to fuel efficiency and supports the aviation industry in meeting high fire safety requirements. In May 2024, Acro Aircraft Seating (Acro) recently unveiled two new seating contracts at the 2024 Aircraft Interiors Expo (AIX) in Hamburg, one with Spanish low-cost carrier Volotea and the other with Saudi Arabia's low-cost airline Flyadeal. This contract supports Acro Aircraft Seating in customizing aircraft seats with a grey vegan leather cover and headrests that combine the brand's trademark Vichy design with its corporate colors. The seats additionally include a unique high-level literature storage and a lower bungee pocket.

Aircraft manufacturers are increasingly adopting sustainable materials and recycled leather. For instance, Generation Phoenix Ltd. provides recycled leather fiber to revolutionize aviation sustainability. The material is up to 45% lighter than typical leather, saving up to US$ 10,000 in fuel expenses and reducing CO2 emissions by 84 tons per aircraft each year. For airlines, this innovation results in substantial environmental and economic benefits. Furthermore, Helios, the company's most recent innovation, converts end-of-life airplane seat covers into entirely recyclable materials, reducing the aviation material's carbon footprint by 30% and eliminating ~3 tons of landfill garbage each year for a 180 aircraft fleet. Further, as consumer demand for environmentally friendly and responsible products increases, the demand for sustainable vegan leather will continue to grow.

The leather for aviation application market analysis has been performed by considering the following segments: type, application, and aircraft type. In terms of type, the market is segmented into genuine leather, artificial leather, polyurethane, polyvinyl chloride, and others. The genuine leather segment held the largest share of the market in 2024. By application, the market is segmented into seats, headrests, armrests, cushions, cabin interiors, and others. The seats segment held the largest share of the market in 2024. In terms of aircraft type, the market is segmented into private aircraft, commercial aircraft, military aircraft, and others. The commercial aircraft segment held the largest share of the leather for aviation application market in 2024.

North America dominated the leather for aviation application market share in terms of revenue in 2024. In North America, the demand for leather in the aviation industry is rising due to a combination of passenger comfort expectations and airline branding strategies. In recent years, airlines have focused heavily on enhancing the customer experience as a competitive differentiator, especially in premium and business class segments. Leather is increasingly preferred for aircraft seating as it provides a high-end look and feel and offers a longer lifespan and easier maintenance than regular fabric. In high-traffic environments like commercial airplanes, the ability to clean and maintain surfaces quickly is crucial, and leather's resistance to spills and wear makes it a practical yet luxurious choice. As carriers seek to improve passenger satisfaction and reduce long-term maintenance costs, leather's aesthetic appeal, durability, and evolving sustainability credentials make it an increasingly strategic material in North America's aviation industry. Additionally, the growth in air travel demand, fueled by economic recovery and tourism resurgence, has led to fleet expansion and aircraft refurbishments, further driving the need for leather interiors.

Moreover, the North American aviation market has seen a shift toward eco-friendly and ethically sourced leather, often produced using water-saving and low-emission tanning processes. These innovations align with the growing environmental accountability pressures faced by airlines. The US and Canada are major hubs for the aviation industry in North America. The Lockheed Martin Corporation, Boeing Company, Airbus SE, Northrop Grumman Corporation, and Honeywell International Inc. are among the major aviation companies operating in these countries.

In the US, the demand for leather for aviation applications has surged owing to the growing emphasis on enhancing passenger comfort and brand image in commercial and private aircraft. Airlines and jet manufacturers are investing in premium cabin experiences, where leather is favored for its luxurious feel, durability, and ease of cleaning compared to fabric alternatives. The post-pandemic recovery in air travel has also prompted airlines to refurbish cabins to attract high-end travelers, leading to more upgrades featuring leather seating and interior trims. According to the Bureau of Transportation Statistics, in April 2023, the US airlines carried 77.5 million system-wide (domestic and international) scheduled service passengers. Furthermore, leather aligns with modern interior design trends emphasizing sophistication and minimalism. In private aviation, where personalization and luxury are paramount, leather remains the material of choice for bespoke interiors. Environmental innovations such as eco-friendly tanning and sustainable leather sourcing are also making it a more acceptable choice amid increasing concerns about sustainability, thus contributing to its rising demand in the US aviation sector.

The leather for aviation application market forecast can help stakeholders plan their growth strategies. San Fang Chemical Industrial Co Ltd; FILWEL Co., Ltd.; BASF SE; Teijin Ltd; Toray Industries Inc; Covestro AG; Wollsdorf Leder Schmidt & Co Ges.m.b.H.; Curtidos Treviño S.A. de C.V.; Wickett-Craig; Super Tannery Ltd.; Elmo Sweden AB; Giriraj Coated Fab PVT. LTD.; Conceria Leonica S.p.A.; ICAIPLAST Spa; and BOXMARK Leather GmbH & Co KG are among the prominent players profiled in the leather for aviation application market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market.

The geographical scope of the leather for aviation application market report focuses on North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America is further segmented into the US, Canada, and Mexico. The market in Europe is segmented into Germany, France, the UK, Italy, Spain, Russia, and the Rest of Europe. The Asia Pacific market is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The leather for aviation application market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, Qatar, Morocco, and the Rest of Middle East & Africa. The market in South & Central America is further segmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com