Full-device Manufacturing Segment Drives US and Costa Rica Medical Contract Manufacturing Market Growth

According to our new research study named "US and Costa Rica Medical Contract Manufacturing Market Forecast to 2031 – Country Analysis – by Service Type and Device Type," the market was valued at US$29.49 billion in 2024 and is projected to reach US$ 62.83 billion by 2031; it is expected to register a CAGR of 11.5% during 2025–2031. The national security tariff investigations, investment in domestic pharmaceutical manufacturing, and hosting of MPO medtech forum are driving the growth of the US and Costa Rica medical contract manufacturing market size. However, the regulatory compliance challenges and supply chain disruptions hinder market growth. Technological advancements and sustainability initiatives are projected to bring new US and Costa Rica medical contract manufacturing market trends in the coming years.

Increased complexity in medical devices represents a strong force driving the US and Costa Rica medical contract manufacturing markets. In the US, the FDA announced over 4,000 device approvals in 2022, with a focus on complex systems, including passive and active implantable devices, robotic devices, and diagnostic devices. These innovations require specialized manufacturing expertise, which is what the healthcare market is seeking to support, high-tech healthcare alternatives in a healthcare beyond borders context. New developments such as AI-integrated neuromodulation implants and wearable biosensors are illustrative of these trends, with companies vying to improve cost structure, production, and time-to-market under new clinical regulatory requirements such as the 21st Century Cures Act. Costa Rica and its biomedical industry have also seen growth, with exports in 2022 exceeding US$1.2 billion, with many organizations producing complex surgical instruments, diagnostic devices, and miniaturized sensors. The country’s strategic location, skilled workforce, and regulatory alignment with international standards attract multinational companies seeking reliable manufacturing for sophisticated devices. Advancements in digital health and minimally invasive technologies are increasing the demand for high-precision, compliant manufacturing processes, positioning both markets to benefit from the ongoing trend of device complexity.

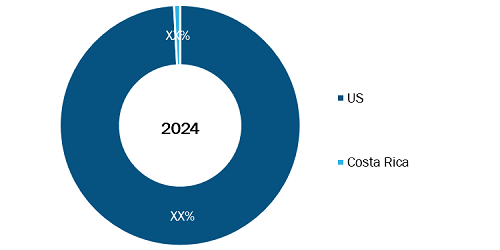

US and Costa Rica Medical Contract Manufacturing Market, by Region, 2024 (%)

US and Costa Rica Medical Contract Manufacturing Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Full-device Manufacturing, Sub-assembly and Components, and Materials-specific Services) and Device Type [IVD Devices (IVD Consumables and IVD Equipment), Diagnostic Imaging Devices, Cardiovascular Devices, Drug Delivery Devices (Infusion Devices and Administration Set, Syringes, Inhalers, and Autoinjectors and Pen Injectors), Orthopedic Devices, Respiratory Care Devices, Ophthalmology Devices, Surgical Devices, Diabetes Care Devices, Dental Devices, Endoscopy and Laparoscopy Devices, Gynecology and Urology Devices, Neurology Devices, Patient Assistive Devices, and Others]

US & Costa Rica Medical Contract Manufacturing Market to 2031

Download Free Sample

Source: The Insight Partners Analysis

US and Costa Rica Medical Contract Manufacturing Market Analysis Based on Segmental Evaluation:

Based on service type, the US and Costa Rica medical contract manufacturing market is segmented into full-device manufacturing, sub-assembly and components, and materials-specific services. The full-device manufacturing segment held the largest US and Costa Rica medical contract manufacturing market share in 2024. Full-device manufacturing is a key growth driver in the US and Costa Rica medical contract manufacturing markets, fueled by rising demand for complex, ready-to-market devices. In the US, OEM's are more frequently outsourcing full-device production to enhance efficiency and address regulatory challenges. Utilizing FDA-registered and ISO 13485-certified facilities, Costa Rica has become a destination for more high-complexity devices such as catheters and implants. The skilled labor and more cost-effective manufacturing capabilities of both countries result in a strong end-to-end manufacturing partner, and a valuable partner in the global medtech supply chain.

Based on device type, the US and Costa Rica medical contract manufacturing market is segmented into IVD devices, diagnostic imaging devices, cardiovascular devices, drug delivery devices, orthopedic devices, respiratory care devices, ophthalmology devices, surgical devices, diabetes care devices, dental devices, endoscopy and laparoscopy devices, gynecology and urology devices, neurology devices, patient assistive devices, and others. The IVD devices segment held a significant US and Costa Rica medical contract manufacturing market share in 2024. The IVD (In Vitro Diagnostic) devices segment is significantly driving medical contract manufacturing in the US and Costa Rica due to increased demand for rapid diagnostics, chronic disease monitoring, and personalized medicine. In the US, advanced research and development and regulatory pathways accelerate the outsourcing of IVD manufacturing to specialized partners. Costa Rica complements this with cost-effective, high-quality production of components such as cartridges and assay platforms. Both countries support scalable, compliant IVD manufacturing, critical for global health initiatives and disease surveillance systems.

The geographical scope of the US and Costa Rica medical contract manufacturing market report includes the assessment of the market performance in the US and Costa Rica. The US dominated the US and Costa Rica medical contract manufacturing market share in 2024. The growth of the US market is influenced by Original Equipment Manufacturers (OEMs) continuing to outsource to acquire specialized expertise and to fulfill regulatory requirements. This will emphasize creating high-complexity devices and advanced manufacturing techniques domestically. The Centers for Medicare & Medicaid Services (CMS) anticipates that national health spending will increase by an average of 5.1% space from 2021 to 2030, thus driving demand for new devices. Demand will concentrate CMO activity in regional markets such as California, Minnesota, and Massachusetts, where they are expected to employ advanced Industry 4.0 technologies such as robotic assembly and AI-assisted inspection to respond to specialized complexity needs for Class II and Class III devices. This activity in the US will focus on high precision and high technology products, which are expected to be supported by near-shoring for volume production. Similarly, the foremost driver for Costa Rica is the role of a near-shoring strategy to the US market, in addition to political stability and a talented workforce that survived medical manufacturing setbacks. As a result of this strategy, the country has been able to position itself and is the second-largest exporter of medical devices in Latin America and the fifth-largest supplier to the US. According to the Costa Rican Investment Promotion Agency (CINDE), medical device exports exceeded US$7.5 billion in 2023, representing a remarkable 42% of the country's total exports of goods. This growth has been supported by the establishment of Free Trade Zones and the diversification of product lines into high-value areas like cardiovascular, respiratory, and neuro-endovascular devices, attracting 14 of the world's top 30 MedTech multinationals.

MICRO; Tegra Medical; DeRoyal Industries; Gauthier Biomedical; Sterling Industries; AVNA; TE Connectivity; Heraeus Group; Cirtec Medical; Resonetics; Freudenberg Group; Biomerics; Viant Medical; Confluent Medical Technologies; Advant Medical; Precision Coating; SMC; Flex LTD; Jabil Inc.; Juno Pacific; HDA Technology are among the leading companies profiled in the US and Costa Rica medical contract manufacturing market report.

Based on service type, the US and Costa Rica medical contract manufacturing market is segmented into full-device manufacturing, sub-assembly and components, and materials-specific services. Based on device type, the US and Costa Rica medical contract manufacturing market is segmented into IVD devices, diagnostic imaging devices, cardiovascular devices, drug delivery devices, orthopedic devices, respiratory care devices, ophthalmology devices, surgical devices, diabetes care devices, dental devices, endoscopy and laparoscopy devices, gynecology and urology devices, neurology devices, patient assistive devices, and others. Geographically, the market is categorized into US and Costa Rica.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com