Glucose Monitoring Segment to Bolster Point of Care Diagnostics Market Growth During 2024–2031

According to our new research study on "Point of Care Diagnostics Market Forecast to 2031 – Global Analysis – by Product, Purchase Mode, Sample, and End User," the market was valued at US$ 37.93 billion in 2024 and is projected to reach US$ 88.83 billion by 2031; it is estimated to register a CAGR of 13.0% during 2024–2031. The Point of Care Diagnostics Market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

The increasing prevalence of infectious diseases and key product launches and developments contribute to the growing Point of Care Diagnostics Market size. However, the product recalls hamper the growth of the market. Further, the integration of artificial intelligence (AI) and machine learning (ML) is expected to bring new Point of Care Diagnostics Market trends in the coming years.

Point of Care Diagnostics Market Share, by Product, 2024 (%)

Point of Care Diagnostics Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Glucose Monitoring {Blood Glucose Meter, Lancet, and Strips}), Infectious Disease Testing {HIV Testing, Influenza Testing, Sexually Transmitted Diseases Testing, Hepatitis C Virus Testing, Tropical Diseases Testing, Respiratory Infection Testing, Hospital Acquired Infections, and Others}), Cardiometabolic Testing {Cardiac Troponin (cTn) Test, Myoglobin Test, and Others}), Pregnancy and Fertility Testing, Coagulation Testing, Tumor/Cancer Marker Testing, Cholesterol Testing, Urinalysis Testing, Hematology Testing, Thyroid Testing, and Others), Purchase Mode (OTC and Prescription), Sample (Blood, Urine, and Others), End User (Healthcare Facilities {Hospitals and Clinics, Diagnostic Centers, and Others}, Homecare, and Others) and Geography

Point of Care Diagnostics Market Report and Opportunities 2031

Download Free Sample

Source: The Insight Partners Analysis

Increasing Prevalence of Infectious Diseases Bolsters Point of Care Diagnostics Market Growth

Point-of-care testing (POCT) is critical for the diagnosis, treatment, and prevention of infectious diseases. It can be used to detect pathogens, including human immunodeficiency virus (HIV), malarial parasites, human papillomavirus (HPV), Ebola, dengue, and Zika viruses, and Mycobacterium tuberculosis (TB bacteria). According to the World Health Organization (WHO) data, 1.3 million people (including 214,000 individuals affected by HIV) succumbed to TB in 2022. Its estimates indicate that 10.6 million individuals worldwide had TB in 2022, including 3.5 million women, 1.3 million children, and 5.8 million men. Additionally, 30 countries with high TB burdens contributed 86–90% of new TB cases during 2022. Eight countries contributed two-thirds of the total, with India leading the way, followed by the Philippines, China, Indonesia, Pakistan, Nigeria, Bangladesh, and South Africa. As per the WHO, HIV has infected over 39.9 million people worldwide. In 2023, people were diagnosed with HIV, out of which 1.3 million people were newly diagnosed, including 77% adults and 57% children. According to a study published by the Joint United Nations Programme on HIV/AIDS (UNAIDS) in 2023, ~630,000 people died due to HIV and associated conditions. As per the European Centre for Disease Prevention and Control, ~2.6 million people in Europe were infected with HIV in 2023. Healthcare-associated infections (HAIs), including central line-associated bloodstream infections and catheter-associated urinary tract infections (UTIs), affect patients in hospitals and other healthcare facilities. According to WHO, ~9 million HAIs occur every year and cause nearly 25 million additional hospitalization days in Europe yearly. As per the same source, HAI leads to an additional financial burden of approximately US$ 14.0-26.0 billion in Europe each year. As per the Office of Disease Prevention and Health Promotion, 1 out of 31 hospitalizations in the US suffer from HAI at any given time. Thus, the increasing prevalence of infectious diseases fuels the demand for point of care test diagnostics.

The Point of Care Diagnostics Market analysis has been carried out by considering the following segments: product, purchase mode, sample, end user, and geography. The point of care diagnostics market, based on product, is divided into glucose monitoring, infectious disease testing, cardiometabolic testing, pregnancy and fertility testing, coagulation testing, tumor/cancer marker testing, cholesterol testing, urinalysis testing, hematology testing, thyroid testing, others. The glucose monitoring segment held the largest share of the Point of Care Diagnostics Market in 2024, and it is expected to register the highest CAGR during 2024–2031. The glucose monitoring devices segment includes glucometers, lancets, testing strips, and other glucose monitoring devices. This segment focuses on devices and technologies designed to measure glucose levels in the blood, providing essential information for diabetes management. The demand for glucose monitoring devices, especially those used in POC settings, is propelled by the soaring prevalence of diabetes, increasing demand for real-time and at-home diagnostic solutions, growing patient preference for self-monitoring of blood glucose (SMBG), and the need for continuous monitoring in clinical environments.

Self-monitoring blood glucose (SMBG) meters, continuous glucose monitors (CGMs), and flash glucose monitors (FGMs) are widely used across patient groups, including those with Type 1 and Type 2 diabetes. Among these, CGMs have witnessed rapid adoption due to their ability to track glucose levels continuously and alert patients to hyperglycemic or hypoglycemic events, which help prevent complications. Abbott’s Freestyle Libre and Dexcom's G6 CGM are highly recognized products in this space, offering real-time glucose data without the need for frequent fingerstick testing. The adoption of these devices is driven by technological advancements such as the development of non-invasive glucose monitoring devices, improvements in the accuracy of measurements, and better integration with digital health platforms. For instance, diamontech GmbH has invented a non-invasive glucose monitoring device. The company offers DMT Base, DMT Pocket, and DMT Band that help diabetes patients monitor their glucose levels. The surging trend of telemedicine and remote patient monitoring further boosts the demand for glucose monitoring products in the point of care diagnostics market.

By purchase mode, the market is segmented into OTC and prescription. The adoption of prescription-based testing is surging as more patients require tests that are specifically recommended or prescribed by healthcare providers for monitoring chronic conditions, diagnosing diseases, or managing ongoing treatments. Prescription-based POC testing includes tests that are ordered by doctors and are used to assess conditions such as diabetes, cardiovascular diseases, infectious diseases, and kidney function. These tests are often more specialized than over-the-counter POC tests, providing results that directly influence medical decisions and treatment plans. Lipid panels, HbA1c tests, and INR tests for anticoagulant therapy require prescriptions for use in POC settings. CoaguChek XS for INR monitoring and Abbott's Afinion 2 for HbA1c and lipid testing allows patients to manage their conditions at home with results that are reviewed and interpreted by healthcare professionals. Advancements in testing technology fuel the demand for prescription-based POC testing. Also, the increasing prevalence of chronic diseases and the growing trend of personalized healthcare require precise, physician-directed diagnostics for better patient outcomes.

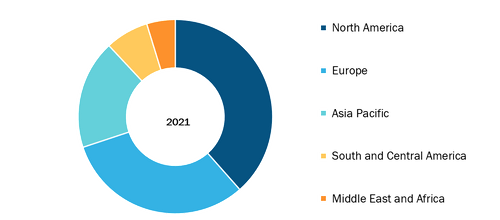

The geographic scope of the Point of Care Diagnostics Market report includes the assessment of the market performance in North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

The US holds the largest market share, followed by Canada. The growing prevalence of infectious diseases, rising government support for advanced diagnostics kits and instruments, increasing efforts in R&D activities undertaken by the market players, and technological advancements in the diagnostics industry fuel the point of care diagnostics market growth in North America. The growth of the US point of care diagnostics market is attributed to the increasing incidence of chronic diseases. As per the National Institute of Health, an estimated 2.04 million new cases and 611,720 cancer deaths were reported in the country in 2024. Breast cancer, lung and bronchus cancer, prostate cancer, colon and rectum cancer, melanoma cancer, and liver cancer are common types of cancer. According to a study published by the Centers for Disease Control and Prevention in 2021, ~38.4 million people are living with diabetes, which is 11.6% of the total population. According to the same study, a higher incidence of diabetes is observed in American youth, and the prevalence of such health conditions boosts the demand for point-of-care diagnostics in the country. Medical technologies are growing, and researchers are coming up with the latest innovations. This growth resulted in the development of advanced medical devices and catalyzed developments and advancements in the healthcare industry. The US is home to companies developing advanced products for point of care diagnosis. In August 2021, Mylab Discovery Solutions collaborated with the US-based Hemex Health for the development of next-generation diagnostic solutions for the Point-of-Care (POC) testing of coronavirus and other diseases. Under the technology partnership, Mylab will develop test assays, and Hemex will provide its Gazelle POC testing platform and expertise.

Infections are prevalent in the country due to the overuse of common antibiotics in medical facilities. According to the CDC 2024 report, 1 in 31 hospital patients have at least one hospital-acquired infection. More than half of all HAIs occurred outside of the intensive care unit (ICU). The US has the presence of two main HAI observation systems that work to understand better and target the areas that need assistance. These organizations include the National Healthcare Safety Network (NHSN) and the Emerging Infections Program HAI Community-Interface (EIP HAIC). Thus, the increasing prevalence of chronic conditions and infections, along with surging strategic initiatives by market players, drive the point of care diagnostics market growth.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com