Surging Awareness Regarding Health Benefits of Organic Flour to Bolster Organic Flour Market Growth

According to our latest study on “Organic Flour Market Size and Forecast (2020–2031), Global and Regional Growth Opportunity Analysis – by Product Type, Category, and Distribution Channel,” the market size is expected to grow from US$ 11.76 billion in 2023 to US$ 19.59 billion by 2031; it is estimated to register a CAGR of 6.6% from 2023 to 2031. The report highlights key factors driving the market growth and prominent players along with their developments in the market.

Organic flour is produced from grains grown without toxic pesticides, synthetic fertilizers, or genetic engineering techniques. Its demand has surged due to increasing consumer preferences for healthier, environmentally friendly, and ethically produced food products. Additionally, the rich nutritional value and potential health benefits of organic foods have contributed to the increase in demand.

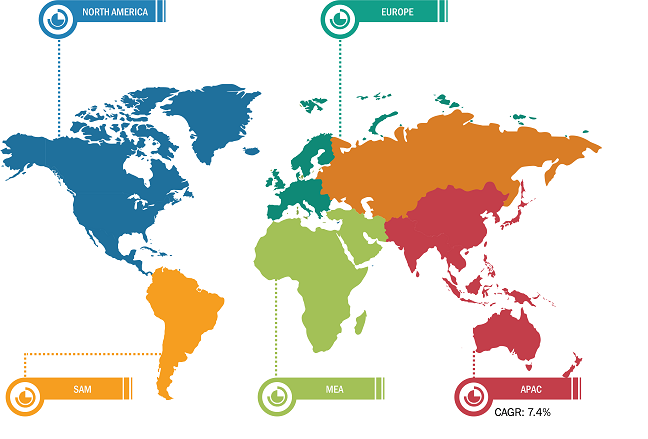

Organic Flour Market Breakdown – by Region

Organic Flour Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Wheat Flour, Oat Flour, Corn Flour, Rice Flour, and Others), Category (Conventional and Gluten-Free), Distribution Channel (Supermarket and Hypermarket, Convenience Stores, Online Retail, and Others)

Organic Flour Market Share and Growth Forecast | 2031

Download Free Sample

Consumers are becoming increasingly aware of the potential health risks associated with pesticide residues and chemical additives in conventional food products, including non-organic flour. This heightened awareness prompts consumers to seek organic alternatives, which is driving the demand for organic flour. As consumers become increasingly health-conscious, there's a growing preference for organic products perceived as healthier alternatives to their conventional counterparts. Organic flour, produced without synthetic pesticides, herbicides, or genetically modified organisms (GMOs), aligns well with this health-conscious mindset. Consumers are increasingly drawn to organic flour due to its perceived purity and nutritional benefits, which include higher levels of essential nutrients such as vitamins, minerals, and antioxidants than conventional flour.

The rising concerns over food safety and environmental sustainability further contribute to the momentum behind the organic flour market. Additionally, the organic farming practices used in producing organic flour, such as crop rotation, soil enrichment, and biodiversity conservation, resonate with environmentally conscious consumers who prioritize sustainability and eco-friendly products. Furthermore, the organic flour market analysis has been performed by considering the following segments: product type, category, and distribution channel. Based on product type, the wheat flour segment is anticipated to hold a significant organic flour market share by 2031.

The organic flour market report emphasizes the key factors driving the market. Various industry players have undertaken strategic initiatives such as mergers & acquisitions, partnerships, campaign launches, and product launches to strengthen their positions and capitalize on emerging opportunities. M&As are prominent strategic initiatives that key players adopt to consolidate market share and expand their product portfolios. For instance, in 2020, ADM acquired the remaining 50% stake in the UK-based organic flour milling company Gleadell Agriculture Ltd. This acquisition enabled ADM to expand its presence in the organic flour market and strengthen its supply chain capabilities.

Partnerships and collaborations are another crucial strategy organic flour manufacturers employ to leverage complementary strengths and resources. By partnering with retailers, distributors, or other food industry players, organic flour producers can enhance their distribution networks, increase brand visibility, and access new sales channels. For instance, King Arthur partnered with various retailers and distributors to expand its distribution network and increase the availability of its organic flour products. Collaborations with grocery chains, specialty food stores, and online retailers have helped King Arthur reach a wider audience of health-conscious consumers.

In terms of revenue, North America dominated the organic flour market share. The US is a major market for organic flour in North America. In North America, the demand for organic flour is rapidly growing as consumers are becoming increasingly aware of the benefits of organic food products, including flour. Organic flour is produced without synthetic pesticides, herbicides, or genetically modified organisms (GMOs), making it a healthier and more environmentally friendly option. This increased awareness of health and sustainability issues encourages consumers to seek organic alternatives to conventional flour, contributing to the rising demand for organic flour. In recent years, the market for organic products has grown rapidly in North America. In total, there are nearly 23,957 organic producers, of which ~18,000 are in the US and over 5,000 in Canada.

The organic flour market trends include the surging demand for gluten-free products. The demand for gluten-free products is emerging, driven by increasing awareness of gluten intolerance, celiac disease, and consumer preferences for healthier alternatives. As more people become aware of the adverse effects, including digestive issues and autoimmune reactions, of gluten on their health, there has been a notable shift toward gluten-free diets. Consumers increasingly seek organic alternatives that are free from synthetic chemicals and devoid of gluten. The gluten-free trend has led to innovations in the organic flour market, with manufacturers exploring alternative grains and flour to expand their gluten-free product offerings. Ancient grains such as quinoa, amaranth, teff, and sorghum are gaining popularity as gluten-free alternatives to traditional wheat flour. Brands such as Arrowhead Mills and King Arthur Baking Company have introduced organic, gluten-free flour blends containing these ancient grains, catering to consumers seeking diverse and nutritious gluten-free options. Overall, the surging demand for gluten-free products drives innovation and diversification within the global organic flour market, offering consumers a more comprehensive selection of gluten-free products.

Hometown Food Company, Bob's Red Mill Natural Foods, Betterbody Foods C/O, FWP Matthews Ltd, Shipton Mill Ltd, W and H Marriage and Sons Limited, Gilchesters Organics, and Anita's Organic Grain & Flour Mill Ltd. are among the prominent players profiled in the organic flour market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting various strategies such as new product launches, capacity expansions, partnerships, and collaborations in order to stay competitive in the market. For instance, in 2022, Dairy major GCMMF, which markets its products under the Amul brand, announced entry into the organic food market with the launch of organic wheat flour. The first product launched in this portfolio is "Amul Organic Whole Wheat Atta." Further, the organic flour market forecast can help stakeholders plan their growth strategies.

The global organic flour market is segmented on the basis of product type, category, distribution channel, and geography. Based on product type, the market is segmented into wheat flour, oat flour, corn flour, rice flour, and others. Based on category, the market is segmented into conventional and gluten-free. By distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. By geography, the organic flour market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The North America market is further segmented into the US, Canada, and Mexico. The market in Europe is sub-segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The Asia Pacific market is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The organic flour market in the Middle East & Africa is further segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The South & Central America market is further segmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com