Insulin Delivery Segment Held Largest Share of Needle-Free Drug Delivery Devices Market in 2023

According to our new research study on "Needle-Free Drug Delivery Devices Market Forecast to 2031 – Global Analysis – by Type and Application," the needle-free drug delivery devices market was valued at US$ 14.76 billion in 2023 and is expected to reach US$ 28.42 billion by 2031; it is anticipated to record a CAGR of 8.5% from 2023 to 2031. The report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth. Increasing prevalence of chronic diseases and increasing needlestick injuries propels the needle-free drug delivery devices market growth. However, the high cost of development as compare to injections hinders the growth of the market. Increasing strategic initiatives are expected to bring new needle-free drug delivery devices market trends in the coming years.

Increasing Strategic Initiatives Acts as Future Trend for Needle-Free Drug Delivery Devices Market Growth

Companies operating in the needle-free drug delivery devices market constantly focus on strategic developments such as collaboration, agreements, partnerships, and new product launches, which help them improve their sales. The new product launches are mainly directed toward increased security, user-friendly features, better dosing capabilities, etc., to attract a large patient base. Through improved dosing capabilities, needle-free drug delivery devices complement the therapeutic outcomes and increase the potential of disease management in home care settings. A few of the noteworthy developments in the drug delivery systems market are mentioned below:

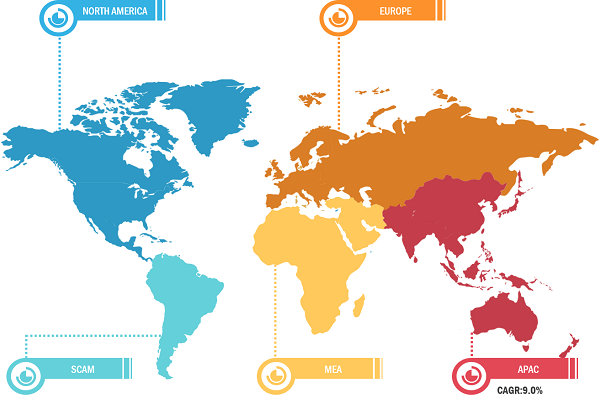

Needle-Free Drug Delivery Devices Market, by Region, 2023 (%)

Needle-Free Drug Delivery Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Inhalers, Jet Injectors, Novel Needles, Transdermal Patches, and Others), Application (Insulin Delivery, Vaccination, Pain Management, and Others), and Geography

Needle-Free Drug Delivery Devices Market Trends, Growth - 2031

Download Free Sample

Source: The Insight Partners Analysis

- In November 2023, Becton, Dickinson and Company (BD) has introduced the new PIVO Pro Needle-free Blood Collection Device following 510(k) clearance from the US Food and Drug Administration (FDA). Designed to be compatible with integrated catheters, the new needle-free blood draw technology is said to further enable BD’s ‘One-Stick Hospital Stay’ vision.

- In March 2023, Stevanato Group collaborated with Recipharm to develop and manufacture pre-fillable syringes that would be integrated into a new soft mist inhaler for inhaling sensitive biological products. The new strategic collaboration aims to provide innovative primary packaging to pharmaceutical and biopharmaceutical companies using Recipharm’s proprietary soft mist inhalers.

- In October 2022, NuGen Medical Devices Inc. launched InsuJet devices in Canada. SOL-MILLENNIUM Medical Group has registered as an exhibitor at the 2022 Diabetes Canada/Canadian Society of Endocrinology and Metabolism (CSEM) Professional Conference, where it will launch InsuJet devices in Canada.

- In June 2022, NovaXS, which was formed at the University of California, Berkeley, designed its patent-pending Telosis technology to administer a narrow stream of medication without a needle in 0.3 seconds, as well as analyze injection data to allow for smarter health decisions.

- In June 2022, Esteve Pharmaceuticals GmbH launched INBRIJA 33 mg (levodopa inhalation powder in hard capsules) in Germany. INBRIJA is indicated in the EU for the intermittent treatment of episodic motor fluctuations in adults suffering from Parkinson’s disease, prescribed with a levodopa/dopa-decarboxylase inhibitor.

- In December 2021, Gerresheimer AG entered into an agreement with American Biotech to develop a pump for drug delivery for the treatment of rare diseases via continuous parenteral administration.

- In November 2020, Medtronic launched InPen integrated with real-time Guardian Connect CGM data. The product provides real-time glucose readings alongside insulin dose information.

Thus, the growing number of such strategic developments and product launches are expected to contribute to the growing needle-free drug delivery devices market size in the coming years.

Based on type, the market is segmented into inhalers, jet injectors, novel needles, transdermal patches, and others. In 2023, the jet injectors segment held the largest needle-free drug delivery devices market share and is expected to record the highest CAGR during 2023–2031. Increasing use of technologically advanced jet injectors, integration of jet injectors with cloud and digital control, and increasing demand for jet injectors for home use is mainly fueling the growth of the jet injectors segment. By application, the market is segmented into insulin delivery, vaccination, pain management, and others. In 2023, the insulin delivery segment held the largest needle-free drug delivery devices market share. However, the personnel location & monitoring segment is expected to record the highest CAGR during 2023–2031. The increasing prevalence and incidence rate of diabetes worldwide and growing focus on the development of devices that deliver insulin without the use of needles are mainly fueling the growth of the segment.

NuGen Medical Devices Inc; NovaXS Biotech; GlaxoSmithKline; AstraZeneca; Roche; Boehringer Ingelheim; Merck; Cipla; Novartis; Teva Pharmaceuticals; Omron Healthcare; and Sumitomo Pharma Co., Ltd are among the prominent players profiled in the needle-free drug delivery devices market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. These companies focus on geographic expansions and latest product launches to meet the rising demand from consumers worldwide and boost their product range in specialty portfolios. Their global presence allows them to serve a large customer base, subsequently facilitating market expansion.

Needle-Free Drug Delivery Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Inhalers, Jet Injectors, Novel Needles, Transdermal Patches, and Others), Application (Insulin Delivery, Vaccination, Pain Management, and Others), and Geography |

|

The needle-free drug delivery devices market is segmented as follows:

The needle-free drug delivery devices market analysis has been carried out by considering the following segments: type, application, and geography. Based on type, the market is segmented into inhalers, jet injectors, novel needles, transdermal patches, and others. By application, the market is segmented into insulin delivery, vaccination, pain management, and others. Geographically, the scope of the needle-free drug delivery devices market report is primarily segmented into North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com