Immunoglobulin Segment, by Type, to Hold Largest Share in Blood Plasma Derivatives Market during 2022–2028

According to our latest study on “Blood Plasma Derivatives Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Type, Application, and End User,” the market is expected to grow from US$ 29,886.12 million in 2022 to US$ 51,119.24 million by 2028; it is estimated to record a CAGR of 9.4% from 2022 to 2028. The report highlights the key factors driving the market growth and prominent players with their developments in the market.

Based on type, the blood plasma derivatives market is segmented into immunoglobulins, albumin, factor VIII, factor IX, hyperimmune globulins, and others. In 2022, the immunoglobulin segment accounted for the largest market share. Also, the same segment is anticipated to register the highest CAGR during 2022–2028 due to high demand for immunoglobulins for immunoglobulin replacement therapy (IgRT). Based on application, the blood plasma derivatives market is segmented into immunodeficiency diseases, hemophilia, hypogammaglobulinemia, von Willebrand disease, and others. In 2022, the immunodeficiency diseases segment held the largest market share. Also, the same segment is expected to register the highest CAGR from 2022 to 2028. Based on end user, the global blood plasma derivatives market is segmented into hospitals, clinics, and others. The hospitals segment held the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period.

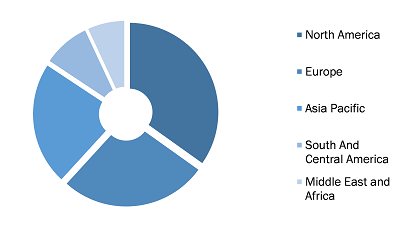

Blood Plasma Derivatives Market, by Region, 2022 (%)

Blood Plasma Derivatives Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type (Albumin, Factor VIII, Factor IX, Immunoglobulin, Hyperimmune Globulin, and Others), Application (Hemophilia, Hypogammaglobulinemia, Immunodeficiency Diseases, von Willebrand’s Diseases, and Others), and End User (Hospitals, Clinics, and Others)

Blood Plasma Derivatives Market Trends and Scope by 2028

Download Free Sample

Source: The Insight Partners Analysis

Plasma derivatives are obtained from explicit plasma proteins by the cycle of fractionation. Blood plasma derivatives contain a high amount of proteins, salts, minerals, hormones, vitamins, and protease inhibitors. Thus, they are commonly used in the treatment of bleeding disorders, hepatitis B, hepatitis C, hemophilia A, immunodeficiency, hypogammaglobulinemia, hemophilia B, and human immunodeficiency virus. The increasing prevalence of blood disorders and rising geriatric population drive the global blood plasma derivatives market growth. However, complicated reimbursement policies for plasma-based therapies in various nations hamper the market growth.

The rising number of COVID-19 cases propelled the demand for blood plasma derivatives. Patients suffering from underlying immunodeficient disorders, including hypogammaglobulinemia and specific antibody deficiency (SDA), were at a greater risk of novel coronavirus infection and more likely to have higher morbidity and mortality. However, only essential procedures were allowed in hospitals during the lockdown, which delayed or canceled the immunoglobulin-based therapies. Additionally, various studies published in PubMed and NCBI by researchers show that intravenous immunoglobulin has demonstrated clinical efficacy in critically ill COVID-19 patients in reducing the rate of mortality. Post-COVID-19 pandemic, there has been a significant increase in the demand for plasma derivatives owing to the surge in immunoglobulin replacement therapies. Thus, the COVID-19 pandemic positively impacted the blood plasma derivatives market.

Grifols SA, SK Plasma Co Ltd, Octapharma AG, Monobind Inc., Intas Pharmaceuticals Ltd, Fusion Health Care Pvt Ltd, Takeda Pharmaceutical Co Ltd, CSL Behring LLC, LFB SA, and Kedrion SpA are among the leading companies operating in the global blood plasma derivatives market.

Various organic and inorganic strategies are adopted by companies operating in the blood plasma derivatives market. Organic strategies mainly include product launches and product approvals. Acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help them strengthen their customer base and expand their product portfolios. A few of the significant developments by key market players are listed below.

- In January 2022, LFB and Kedrion joined forces in an industrial cooperation agreement to increase the availability of immunoglobulin, a plasma-derived medicine, for patients in France. In the framework of this industrial partnership, Kedrion will manufacture immunoglobulins in Hungary from LFB plasma collected in France by the “Etablissement Français du Sang” (EFS). These immunoglobulins will be imported by LFB in France and will complement LFB’s own immunoglobulins, which will be made available to hospitals in France, in agreement with and under the control of French health authorities.

- In June 2021, CSL Behring announced that the Centers for Medicare & Medicaid Services (CMS) had approved Hizentra for coverage under Medicare Part B for treating Chronic Inflammatory Demyelinating Polyneuropathy (CIDP). The new coverage, effective for dates of service on or after July 18, 2021, will reduce out-of-pocket costs for patients and include coverage of the self-infusion pump, supplies, medication, and nurse training. Hizentra will be the only self-infusion treatment for CIDP covered under the same benefit category as other Ig CIDP treatment options.

- In February 2020, CSL Behring announced that the US Food and Drug Administration (FDA) had granted Privigen [Immune Globulin Intravenous (Human),10% Liquid] orphan-drug designation as an investigational therapy in the treatment of Systemic Sclerosis (SSc). Privigen is currently approved in the US to treat patients affected by primary immunodeficiency (PI), chronic inflammatory demyelinating polyneuropathy (CIDP), and chronic immune thrombocytopenic purpura (ITP).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com